Analysis of the latest data from the FCA’s Financial Lives Survey by retirement specialist Just Group highlights the number ‘zombie buyers’ of annuities who do not shop around to find the best rate and could be missing out on hundreds of pounds a year.

One in three (33%) of adults aged 50 plus who bought an annuity in the last four years said they had not compared the products and prices of two or more providers before purchasing their guaranteed income for life. More than one third (35%) of the same group said that they had purchased from the same provider they used to save with and a further 12% were unsure if they had done so. Comparisons of the latest standard rates available in the guaranteed income for life market finds that ‘zombie buyers’ could be missing out on more than £400 a year by not shopping around for the best rate available.

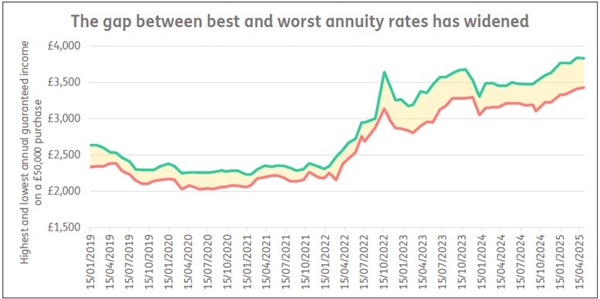

Not only have the rates on offer from annuities risen in recent years, but the gap between the best and worst-paying annuities has also widened (see chart below).

As well as shopping around for the best standard rate, annuity buyers could also benefit from a personalised rate, taking into account health and lifestyle factors, which could give a higher income. Yet, three-quarters (74%) of adults aged 50-69 planning to access their DC pension in the next 2 years did not know that certain health conditions could increase their annuity income, according to the FCA.

Stephen Lowe, group communications director at retirement specialist Just Group, said: “Higher rates on guaranteed income for life products have increased customer interest but there are still too many ‘zombie buyers’ who are not shopping around to get the best annuity deals available.

“Over the course of an entire retirement, a saver failing to shop around could be missing out on thousands of pounds of extra income – the closest thing in the financial world to being given ‘free money.’ “Anyone considering purchasing an annuity should shop around the open market and ensure they disclose information on health and lifestyle factors to make sure they get a personalised rate – all of which will help them secure the best rate on offer to them.”

He recommends all retirees should take the free, independent and impartial guidance from the government-backed Pension Wise service. Professional annuity brokers or financial advisers can help choose options and compare between providers.

|