The vast majority of State Pension Age adults in the UK view the State Pension as an entitlement, with 94% agreeing with this statement and only 4% seeing it as a benefit, according to new research from retirement specialist Just Group.

The Government describes the State Pension in legislation as a “benefit” to root it within the social security

framework.

Despite continued public debate over the future viability of the State Pension, more than half (58%) of people aged over 66 also believe that the State Pension is affordable for the country over the long-term. Less than a fifth (18%) disagree, with around a quarter (24%) unsure.

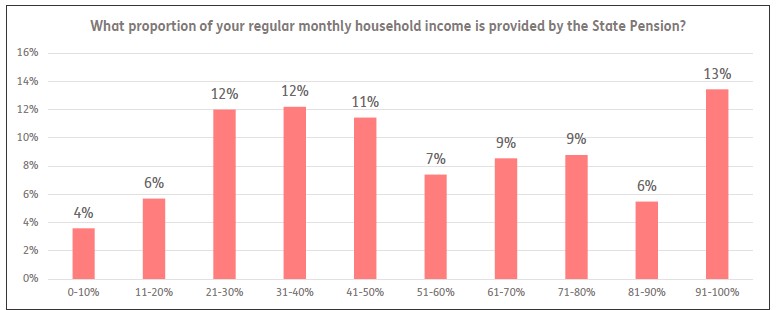

The research also uncovers the importance of the State Pension to the majority of retirees’ retirement income. Around one in seven (13%) of over 66s said that the State Pension accounted for over 90% of their monthly household income with 44% saying that it represented more than half of their household income.

When it comes to questions of fairness around the Triple Lock mechanism, two-thirds (64%) of over 66s said that the Triple Lock was fair to older generations but only 16% said it was fair to younger generations with a similar proportion (18%) saying it wasn’t fair to any generation.

Stephen Lowe, group communications director at retirement specialist Just Group, said: “As a result of rising longevity and dropping birth-rates, it is estimated that a quarter of the UK’s population will be aged 65 or older by 2050. This means that the burden of funding the State Pension will fall on a shrinking proportion of working people. The State Pension Age review is due in the next 18 months, it appears that if the Government wants to avoid increasing taxes or means-testing the State Pension then it may have to look at options either to increase the age at which people receive the State Pension or to moderate the amount paid.

“Neither of these are political vote winners – and as we have seen with the winter fuel and disability payments, once a benefit is introduced it becomes extremely difficult to reduce or withdraw that support. If the government does bring in changes to the State Pension – either to the amount or the age at which it is paid – then it makes sense for people who are not yet receiving it to build up some resilience against those changes.

“This is important because more than four in ten of current recipients tell us the State Pension accounts for the majority of their income and there is a significant proportion wholly reliant on it. Our own research also shows that more than six in 10 (62%) retire before they start receiving the State Pension, sometimes due to redundancy or ill-health. So if the Government either limits the amount paid or pushes out the age at which the State Pension Age can be claimed, then some people will face a wider financial gap than they planned and will need to cover it from their own resources.

“One of the best ways for individuals to prepare for this possibility is to build up private pensions and saving. “The additional income required on top of the State Pension to reach an acceptable minimum living standard – or even a moderate income in retirement – will be achievable for many people. The latest PLSA Retirement Living Standards show a couple where both are receiving the full State Pension will already meet the minimum income threshold. To bump that up to the PLSA’s moderate retirement living standard, they would need to create around £20,000 additional income per year combined, on top of the current full State Pension.

“There are a range of services that pension savers can turn to for help and guidance on whether they’re on track for the retirement they want. The government’s free, independent and impartial guidance services, Pension Wise and MoneyHelper, are good places to start.”

|