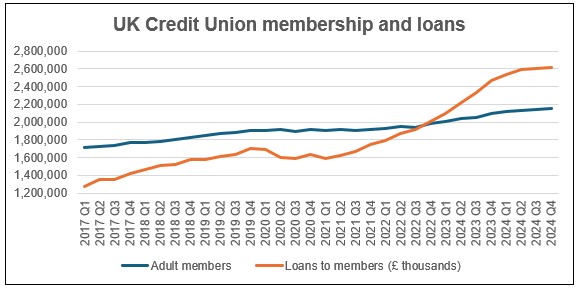

Loans to members also registered another notable increase rising £146 million through 2024 from £2.465 billion (end of 2023) to £2.611 billion (end of 2024).

Both metrics have seen significant increases over the past few years as a valuable resource for individuals struggling to access mainstream credit as many Credit Unions have a social mission to support and offer an alternative to high-cost credit.

Credit Unions are not-for-profit financial cooperatives providing banking services but differ from traditional banks as you become a member rather than a customer, similar to building societies. Membership is based on a common bond – typically region or profession.

Richard Pinch, Senior Director, Risk, at Broadstone, said: “Adult membership of Credit Unions has expanded significantly over the past five years and continued its upward trajectory in 2024. The surge in popularity reflects growing demand for alternatives to the mainstream lending sector, particularly those that could offer greater flexibility as the cost of borrowing has risen since the pandemic. Credit Unions are one of the country’s best-kept secrets for potential borrowers, providing secure and responsible lending as well as rates that are affordable relative to many other high-cost, short-term options. Another bonus of Credit Unions is that they offer attractive rates to savers, who also benefit from the knowledge that their deposits are helping to provide loans for other members.”

Bank of England Statistics

|