September often signals fresh starts. As children head back to school, many adults are also making big changes - with a ‘September Surge’ in job moves after the summer break. But while new roles bring fresh opportunities, they also trigger important financial decisions that can impact your long-term future.

Jemma Slingo, Investment and Pensions Specialist, Fidelity International, shares five key steps to consider if you’re starting a new job this autumn.

1. Look out for pension perks

“Most employees are automatically enrolled in a workplace pension - with you contributing at least 5% of qualifying earnings and your employer adding a minimum of 3%. But many firms go further. Some match your contributions, and a few even double them. This means we begin investing for retirement immediately and with minimal fuss.

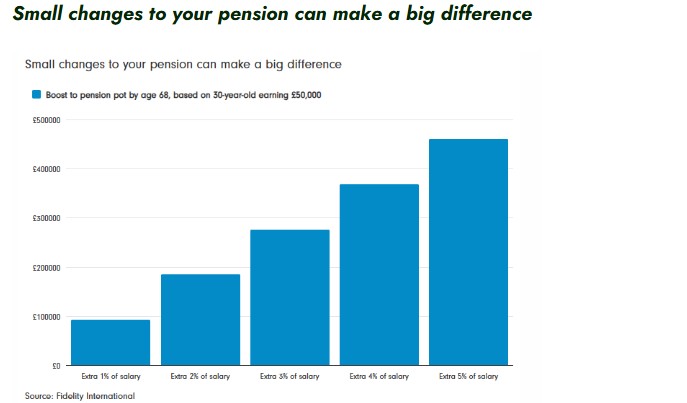

“An extra 1% tucked into your pension today could translate into tens of thousands of pounds at retirement. Fidelity’s Power of Small Amounts calculator shows that for a 30-year-old on a £50,000 salary, paying just £10 more per week could boost their retirement savings by around £92,000 by age 68.

2. Review your savings strategy

“A common guideline is the ‘half your age’ rule: contribute at least half your age (as a percentage of your salary) into your pension. The earlier you start, the less you’ll need to put away. So, if you start at 22, you might want to contribute 11% of earnings over the course of your career. If you delay starting a pension until 32, however, you will need to contribute around 16% of earnings for the rest of your working life to accumulate a similar sized pot.

“Your new employer’s contributions will help, but you’ll likely need to top up your own contributions to stay on track. That said, remember this is just a benchmark, not a hard-and-fast rule. Everyone’s retirement ambitions look different. Some people want the option of retiring early or funding more luxuries later in life, while others may simply want the reassurance of covering the essentials.

“It’s also normal for contributions to increase and decrease with your circumstances - you might start small and increase with pay rises or bonuses. Don’t worry if you’re not always hitting the ‘half your age’ mark; building the habit and adjusting when you can matters most.

3. Track down old pension pots

“Across the UK, more than £31 billion sits in lost or forgotten pensions. When you change jobs, review your savings and consider consolidating. Combining pots can simplify management, cut fees and give a clearer view of your retirement fund. But it’s not always the best option - some schemes offer benefits such as loyalty bonuses, life cover or early access that you could lose. The government’s Pension Tracing Service can help track old pots, and over-50s can access free guidance through Pension Wise.

4. Beware of salary tax traps

“New jobs often come with bigger pay packets - and while that’s good news, higher earners risk falling into avoidable tax traps. One of the most costly is the so-called 60% tax trap, which affects those earning between £100,000 and £125,140 a year. At the £100,000 mark, your personal allowance - the £12,570 you can usually earn tax-free - starts to taper away. The result is that income in this band is effectively taxed at 60%, before National Insurance.

“For example, someone on £125,140 pays around £15,000 more in tax than someone on £100,000, despite only earning £25,140 extra. That’s why careful planning is essential. One way to offset this is to boost pension contributions through salary sacrifice. This lowers your taxable income, helping to preserve your personal allowance, reduce your overall tax bill, and increase your retirement savings at the same time.

5. Check out lesser-known benefits

“Perks can vary dramatically between employers. From private health cover and life insurance to cycle-to-work schemes and electric vehicle incentives, benefits can meaningfully add to your overall package - and in some cases, reduce your tax burden. It’s also worth exploring any educational or financial wellness resources your employer provides, such as webinars, planning tools, or guidance sessions, as these can help you make smarter use of your pay and benefits.”

|