The survey results highlighted that:

• 14% of respondents have deployed or experimented with agentic AI or generative AI in underwriting processes. However, 65% of respondents have not yet done so in underwriting or claims processes and 12% say they have no plans to utilise the capability.

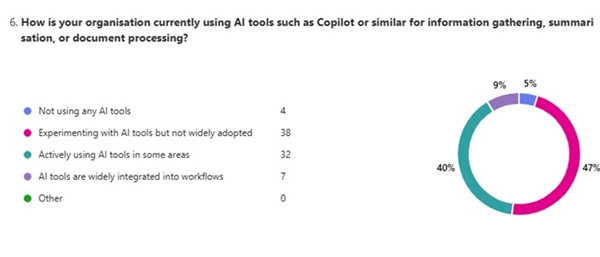

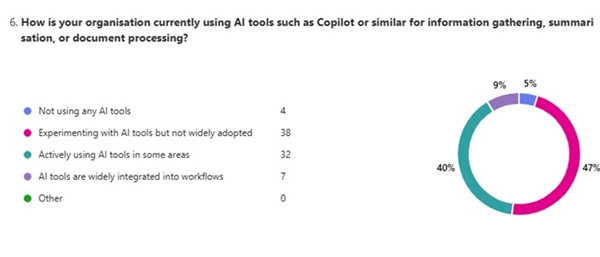

• AI usage is at an early adopter stage for most respondents, with 47% experimenting with AI tools, but without wide adoption. However, 40% say that AI tools are actively used in some areas or even widely integrated into workflows.

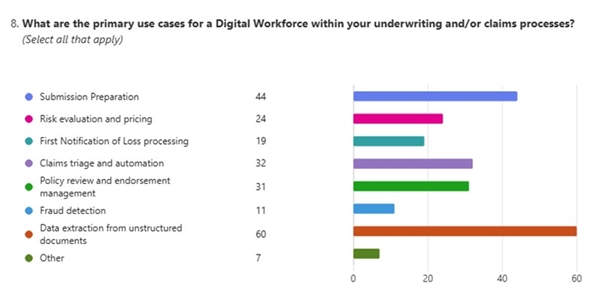

Uses of AI centre around data extraction

The primary use case for a digital workforce within underwriting and/or claims processes is currently seen to be for data extraction from unstructured documents – used by almost three-quarters (74%) of respondents. But over half of respondents (54%) use AI for submission preparation, while one-third believe AI has a significant use case for claims triage and automation of simple tasks and policy review/endorsement management. Only 14% saw fraud detection as a primary use case for a digital workforce.

Barriers remain significant

Respondents highlighted some of the barriers to adoption of AI within underwriting and claims operations. Data quality and availability issues were cited by just under half (49%) of respondents, integration with existing systems was a problem for 46% and cost coupled with the uncertain return on investment was an issue for 48%.*

Rob Myers, Consultant at the Lloyd’s Market Association commented: “We are hosting our AI event to inform our members and the wider market on the opportunity in front of them and to facilitate the market stepping forward and building out its AI expertise and capabilities. Although it is encouraging to see that one-third of companies are already deploying agentic AI or generative AI, it is surprising to note that half of survey respondents have not yet tested its capabilities. We have a chance to consider how the complexities of the London specialty market can be a magnet, rather than a barrier, for deployment of ‘intelligence as a service’ that agentic AI solutions offer. AI has, as our survey highlights, a significant use case within data extraction, submission preparation and claims triage – all of these are significant time requirements for insurers and brokers today.”

|