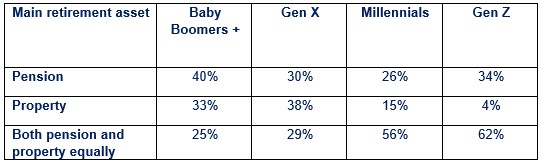

Millennials and Gen Z see both pensions and property playing a significant role in funding their retirement, according to Standard Life’s Retirement Voice research. This stands in stark contrast to the attitudes of older generations, who tend to rely on just one of these assets.

The majority of Millennials (56%) and Gen Z believe they’ll use both property and pensions to fund their retirement – roughly double the amount of Gen X and Baby Boomers who say the same (29% and 25% respectively). Baby Boomers favoured single source of income in retirement is pensions (40%), while Gen X are the only generation favouring property (38%).

Why pensions still matter

Standard Life’s research, conducted among 6,000 people, highlights how pensions remain a crucial part of retirement funding, with a quarter (26%) of Millennials and a third (34%) of Gen Z expecting pensions to be their main retirement asset. In contrast, far fewer are expecting to rely just on property as their main retirement income (15% among Millennials and just 4% among Gen Z). This is compared to 33% of Boomers and 38% of Gen X who expect property to mainly fund their retirement.

It’s perhaps unsurprising that fewer younger people feel property alone can support them in retirement. Given today’s housing and mortgage market, younger generations face significant challenges in getting onto the property ladder – with a third (33%) of Millennials, and more than half (56%) of Gen Z currently either renting or living with loved ones.

As people move through different life stages their attitudes might shift. Baby Boomers, for example, may have initially seen property as a key asset but later realised the practical difficulties of accessing their home’s value via downsizing or relocating.

Commenting on the property vs pension question, Mike Ambery, Retirement Savings Director at Standard Life, part of Phoenix Group said: “Younger generations seem to be taking a more flexible approach to retirement, seeing both pensions and property as key parts of their financial future. It’s smart to build a well-rounded plan, with as many bases covered as possible. While pensions offer tax perks and employer contributions, property provides long-term security and, crucially, a roof over your head.

“Those who are unable to or who choose not to get on the property ladder through their working lives and rent in retirement will need additional savings to cover housing costs alongside day-to-day expenses. Gen X is in a unique position, falling between the era of widespread Defined Benefit pensions and the introduction of auto-enrolment in 2012 while often benefitting from a more accessible housing market than Millennials – making property a more viable option for them. The key for everyone is to plan ahead and keep all options open.”

|