New research from Premium Credit, shows more than half of SMEs are continuing to use credit to ensure they maintain insurance cover despite rising premiums.

Premium Credit’s Insurance Index, which monitors insurance buying and how it is financed, shows 54% of SMEs (55% in 2024) use some form of credit to pay for insurance, borrowing an average £1,180. Around 15% of them say they have borrowed more than £3,000.

The average amount borrowed (£1,180) is almost 10% higher than the £1,080 recorded last year. Two years ago the index3 found 51% of SMEs were using credit to pay for insurance and borrowing an average £1,130.

More than half (51%) of SMEs report that the cost of their business insurance has increased in the past 12 months with 10% saying it has increased dramatically. Last year’s index found 50% saying the cost of their insurance had increased with 12% saying it had increased dramatically.

The index found SMEs continue to reduce levels of cover with 26% saying they have reduced the level of cover on at least one business insurance policy. That compares with 27% reducing cover in last year’s index and 25% cutting cover in the 2023 index. This year’s index found vehicle, employers’ liability and property insurance cover were most likely to be reduced in the year ahead.

Around one in five (19%) SMEs which reduced the general level of cover cancelled at least one policy which is lower than the 25% doing so last year and substantially lower than the 32% in 2023.

This year’s index found that of those companies using credit to pay for their insurance, 17% said they had taken on more credit in the past year while 26% had cut borrowing and 37% were borrowing the same amount. That compares to 18% who said they had taken on more credit in last year’s index which also found 25% had borrowed less and 37% had borrowed the same.

Nearly two out of five (38%) businesses turning to credit used finance from insurance and premium finance companies which is higher than the 34% last year. The numbers using credit cards remained at 45% this year while the numbers using personal or business loans dropped slightly this year to 21% from 22%.

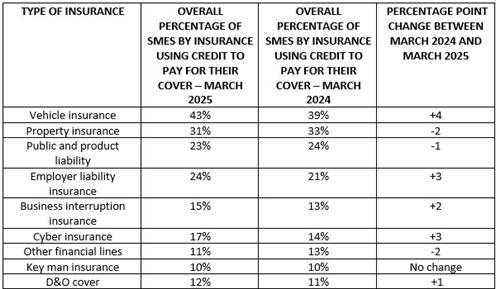

The table below shows the percentage of SMEs which use credit to buy insurance, which products they use it for and how numbers have changed in the past year.

Premium Credit’s research shows the consequences of being underinsured or cancelling policies. Around one in eight (12%) firms questioned this year said they had missed out on claims in the past five years, unchanged from last year’s index and slightly down on 14% in the 2023 index. For around 44% of those unable to claim the damage was valued at £3,000 or more.

Owen Thomas, Chief Sales Officer, at Premium Credit commented: “Credit plays a vital role in ensuring SMEs can continue to fund the insurance they need to grow their businesses, with premium finance options a growing and important part of the credit mix. The rising cost of insurance premiums is a challenge but being underinsured or not having any cover at all is even more of a concern, so it is a worry that SMEs continue to cut back on levels of cover and even cancel policies. The money lost on claims that firms are not able to make shows the risk in being underinsured.”

|