Bequeathing cash to loved ones after death is not a key retirement objective for most people aged 60+, new research into the experiences and attitudes of the ‘baby boom’ generation suggest.

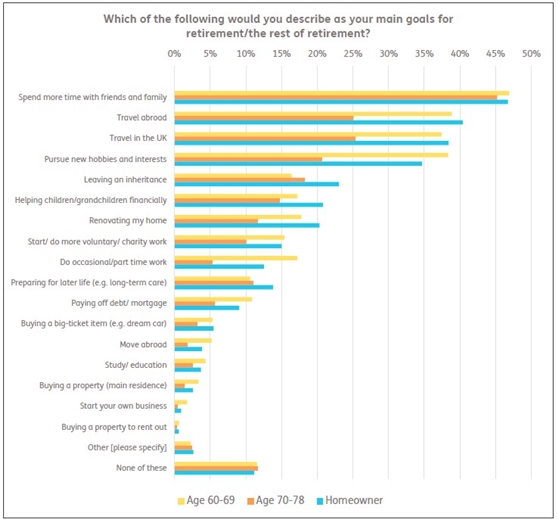

The in-depth consumer insight programme GenVoices from retirement specialist Just Group provides a comprehensive understanding of the experiences and attitudes of Baby Boomers, those born between 1946-1964, aged between 60-78 this year. The top retirement objective for this group was to spend more time with friends and family, chosen by nearly half (46%). Next were travel abroad (37%) and travel in the UK (36%) and to pursue new hobbies and interests (34%).

One in five (20%) of this cohort chose leaving an inheritance as one of their top five goals for retirement, although a significant minority chose helping children and grandchildren with their finances (18%), sometimes called a ‘living inheritance’. Only 3% of current homeowners envisaged buying a different main home while 20% said they wanted to renovate their own home. Among renters, 4% wanted to buy a home.

Overall, 4% chose moving abroad and the same proportion chose study/education, 1% wanted to start a business and the same proportion planned to buy a property to rent out.

Stephen Lowe, group communications director at Just Group, said: “Inheritance and estate taxes are hot topics, but the research suggests that leaving money is not high on the retirement agenda of most Baby Boomers. Even among the oldest in this group – those aged 70-78 – and those on the highest household incomes (£100k+) still only about a quarter put leaving cash as one of their top priorities. Almost the same proportion (18%) who want to leave an inheritance say they want to provide financial help to children or grandchildren while still alive.

“Overall, the priority of most seems to be to kick back and relax by spending time with friends and family or pursuing travel and hobbies – over other options such as working part-time or volunteering, setting up their own business or studying. Although Baby Boomers are often seen as the most financially privileged generation, the research suggests an awareness among most of this cohort that they have finite resources that will mostly be used up during their remaining lifetime.

“Longevity increases during their lifetimes mean they face more years in retirement, which translates into higher costs, particularly if they need professional care later in life. While about 70% own their homes, around one in seven of this group still have mortgages. Many of the non-homeowners will face paying rising rents over time. The wealthier tiers are quite comfortable, but the bigger picture runs against the common perception that Boomers are awash with dosh. The reality is that most Boomers are going to need to be careful with their cash and probably feel leaving money is a hope and not an expectation.”

|