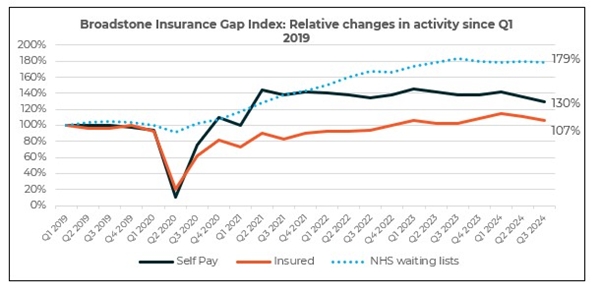

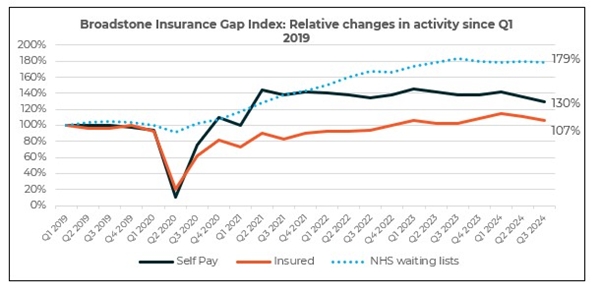

Analysis of the latest quarterly Private Healthcare Information Network (PHIN) data reveals that businesses continue to drive private healthcare admissions, as NHS waiting lists stagnate at record highs and employers look to Private Medical Insurance (PMI) to protect productivity and long-term growth.

The research from Broadstone, a leading independent consultancy, shows that treatments funded through PMI registered a 5% uptick from the same quarter in the prior year, rising from 151,000 to 158,000 in the latest quarter. In fact, 80% of UK private medical cover is delivered through employee benefit programmes funded by employers.

Conversely, self-pay admissions continued their gradual decline in the third quarter of the year, falling by 6% between Q3 2023 (69,000) and Q3 2024 (65,000), stagnating at 107% of pre-pandemic levels.

Overall, this meant that total private healthcare admissions registered their highest third quarter on record of 223,000 in 2024. It reflects a growing trend of PMI driving record levels of growth in the private healthcare market. Post-pandemic demand for self-pay treatment is levelling out, while businesses increasingly offer insurance solutions and wider preventive healthcare benefits to help tackle rising levels of workplace sickness.

In Q3 2024, PMI funded treatments equalled over seven in ten (71%) of all admissions with the gap in admissions between those paying with PMI and those using ‘self-pay’ increasing year on year, reaching 93,000 in Q3 2024 compared to 82,000 in Q3 2023.

Brett Hill, Head of Health & Protection at Broadstone, commented: “With NHS waiting lists stagnating at record highs, employers increasingly see PMI as essential to maintaining a healthy and productive workforce. Beyond fast access to diagnostic tests and hospital care, PMI provides direct access to treatment for mental health and musculoskeletal conditions – two of the biggest drivers of workplace sickness absence – and primary care benefits such as GP services, helping employees stay well and reducing costly long-term absences. The continued rise in PMI-funded treatments highlights its growing role in the healthcare system but also brings challenges - higher claims volumes are driving up costs. To manage this, businesses should consider investing in proactive, preventative health initiatives to reduce the need for costly, complex treatments down the line.”

|