The quarterly Defined Benefit (DB) Redress Tracker from leading independent financial services consultancy Broadstone provides an indicator of the level of compensation due to those who were previously ill-advised to transfer out of their DB pension.

Broadstone’s DB Redress Tracker follows the example of an individual who left their scheme in 2018 aged 50, with a pension of £10,000 p.a. which would receive inflation-linked increases when in payment. The Tracker is developed in line with Financial Conduct Authority (FCA) rules for calculating redress with the individual assumed to have invested their funds to earn returns in line with the FTSE Private Investor Index.

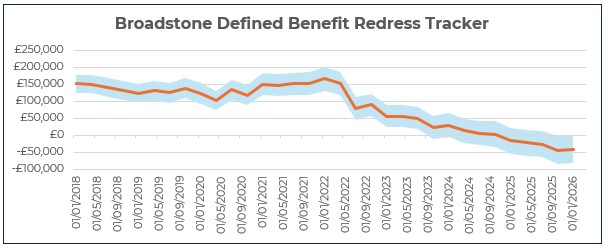

The latest update shows that the central estimate of compensation for a typical pension transfer redress case ‘increased’ slightly from –£44,000 to -£41,000 between Q4 2025 and Q1 2026. This means the example consumer has been calculated to be better off as a result of the transfer.

Prior to 2025, redress was typically payable in pension transfer cases, however, this dropped through 2025 such that most cases now result in a conclusion of no loss. Redress fell by approximately £25,000 from around -£16,000 in Q1 2025 to around -£41,000 in Q1 2026.

In fact, compensation has seen a radical decline in the last four years - after peaking at £165,000 in Q1 2022, it has fallen by more than £200,000 to -£41,000, as illustrated in the tracker below.

It must be noted that there is a correlation between likelihood of a consumer claiming and redress being payable. That is, where a consumer is confident that they benefited from the transfer, they are less likely to make a claim.

By contrast, claims are more likely where a consumer has concerns about the advice received, often driven by a perception that they are now financially worse off as a result of the transfer.

Key indicators that suggest redress is more likely on individual cases include a high “critical yield” at the point of transfer, poor investment performance post-transfer, younger age at transfer, or older cases, particularly those dating back to before 2010.

Simon Robinson, Senior Consultant and Actuary at Broadstone, commented: “The average level of DB transfer redress remains historically low and means that most cases will still show “no loss” at the beginning of 2026. Despite this, we are still seeing many cases where compensation is due. A high critical yield at the time of transfer is often a warning sign that a claim will arise and redress become payable. Firms should review their historic transfer business to identify any cases of particular concern.”

|