A new report from the Standard Life Centre for the Future of Retirement identifies a marked rise in financial insecurity among people in their early 60s as the State Pension age has increased over the past 15 years.

The report’s analysis highlights there are 250,000 more people aged 60-64 in relative income poverty than in 2010 when the State Pension age increases began, making this the adult age group which has experienced the largest deterioration. The poverty rate for 60-64-year-olds has increased from 16% in 2009-10 to 22% in 2023-24.

The findings are published in a new report titled, Jam Tomorrow? Work, finances and retirement in an era of a rising State Pension age1, which also recommends practical ideas for how government can help mitigate the negative impacts of a higher State Pension age.

State pension age will increase again next April

The report highlights that despite rises in life expectancy the State Pension ages of 65 for men and 60 for women remained unchanged for six decades from its founding in 1948. However, for most years since 2010, it has been increasing, with the next rise kicking in from next April gradually reaching 67 for both men and women by 2028.

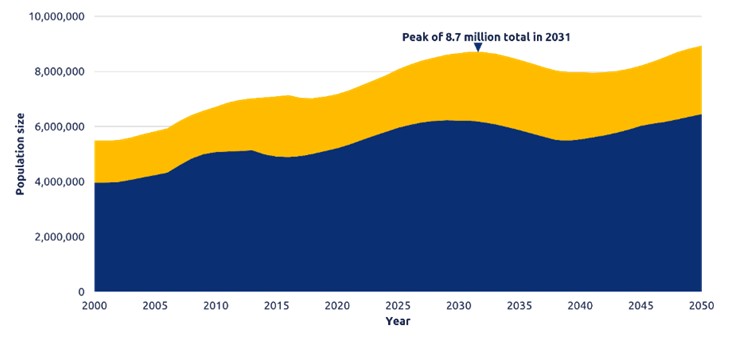

This period of rapid adjustment coincides with significant demographic change and the report shows there are now 8 million people in UK in their 60s, up from 6.7 million in 2010, and this is expected to peak at 8.7 million in 2031 (see figure 1 below).

Figure 1: Total number of people aged 60-66 and 67-69: UK, 2000 to 2050

The Standard Life Centre for the Future of Retirement finds that pre-retirement poverty is likely to rise further as the State Pension age begins to increase again next year. Without targeted mitigation, more people could face a prolonged period of financial insecurity before receiving the State Pension.

Longer working lives but significant risk of people falling out of work

Many people have responded to a later State Pension age by working for longer and the report finds the employment rate for 64-year-olds has risen from 34% in 2013 to 54% today but notes that this uplift is concentrated among people who were already in work2. Those who leave the labour market in their 50s and early 60s remain unlikely to return, increasing their risk of low income. When the State Pension age rose from 65 to 66, the proportion of 65-year-olds in income poverty more than doubled, from 10% to 24%.

Figure 2: Employment rate by individual year of age: UK, 2013 and 2025

State Pension Age Review and Pensions Commission must be mindful of the impact of further increases – potential solutions

The report has been published at time when work on both the government’s Third State Pension age review and Pensions Commission is underway. The Standard Life Centre for the Future of Retirement have provided oral evidence to the Work and Pensions Select Committee’s new inquiry into the case for providing additional support to mitigate the impacts of pre-retirement poverty as we transition to a new State Pension age.

One solution advocated by the report is to explore how the savings to public spending (estimated to be £10bn per year from raising the State Pension age to 67) could in part be used for policies to help support those most negatively impacted.

Targeted funding could be put towards initiatives focused on helping people to work for longer, enabling them to save more for retirement. The report also recommends providing better support to people to help them make good decumulation decisions when it’s time to access their pension savings, based on their specific circumstances. In combination these policies could help both individuals and contribute higher economic activity and tax revenue.

Patrick Thomson, Head of Research Analysis and Policy at the Standard Life Centre for the Future of Retirement, said: “For the first 60 years of its existence the State Pension age stayed the same. Since 2010 it has been rising in more years than not, and a growing number of people are falling into poverty as they wait for a higher State Pension age. Next year we will begin to see another rise from 66 to 67 which will save £10bn a year but have knock on costs and consequences for poverty levels.

“The change will come at a huge cost to some - our analysis shows over 250,000 additional 60–64-year-olds now in pre-retirement poverty compared with 2010, and the proportion of 65-year-olds in poverty more than doubled when the State Pension age moved from 65 to 66. Our research with the public shows that most people accept that the State Pension age may need to rise over time, but this needs to be done in a way that is seen as fair between generations. Any further increases must be matched by clear policies to help people stay in good work for longer and protect those who cannot.

“We know that there is a good chance that 66 year olds will see their rates of poverty double over the next few years unless we take action. We will spend £10bn less on them each year, and could target some of that to help people to stay in good work in their 60s and to cushion the impact on those most at risk. The State Pension matters to people, and we need to build public confidence in a fair system for today and for tomorrow”.

|