|

|

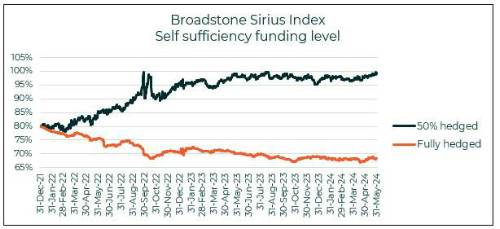

Half hedged scheme funding improves from 98.3% to 99.0%. Fully hedged scheme funding also rises from 67.5% to 68.2%. Incoming government set to inherit stable funding environment to set policy direction. |

The Broadstone Sirius Index – a monitor of how various pension scheme strategies are performing on their journeys to self-sufficiency – posts its latest update.

The Broadstone Sirius Index finds that the 50% hedged scheme is nearing full funding amid continued improvements to its funding position through May, recording a high of 99.7% near the end of May as it approaches full funding.

On a month-to-month basis, the scheme posted notable gains, rising from 98.3% to 99.0% as a slight reduction in yields saw liabilities and hedging assets rise.

The fully hedged scheme also saw funding improvements, rising from 67.5% to 68.2%.

Chris Rice, Head of Trustee Services at Broadstone, commented: "Both of our example schemes improved their funding positions in May following a reduction in yields which drove liabilities and assets higher.’

“It is also encouraging to note that both schemes’ funding levels have remained relatively stable for over a year now, and we would expect that the majority of defined benefit schemes have adapted to their new funding positions and adjusted their long-term investment and funding strategies accordingly.

“As we enter the General Election period, it looks likely that the next government will inherit a stable defined benefit pension scheme funding environment,” he said. “This will help it consider and develop long-term policy regarding well-funded schemes that are targeting buy-out in a hot insurance market, the emerging consolidation options and/or run on as well as those schemes where there is still work to do.

“This will allow trustees to work with employers to set realistic and affordable medium to long-term strategies.”

|

|

|

|

| Senior Pricing & Portfolio Management... | ||

| London - £150,000 Per Annum | ||

| Pricing Transformation Lead | ||

| London - £85,000 Per Annum | ||

| Lead Capital Actuary | ||

| London - £150,000 Per Annum | ||

| Take the lead on capital oversight | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Be at the forefront of creative GI co... | ||

| London/hybrid 2-3dpw office-based - Negotiable | ||

| Remote Market and Credit Risk Calibra... | ||

| Remote - Negotiable | ||

| Contact us about a Capital Contract i... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Head of Insurance Risk | ||

| London - £160,000 Per Annum | ||

| Director - Pensions Risk Transfer (PRT) | ||

| London, Midlands, North West - hybrid working 2dpw in the office - Negotiable | ||

| Dip a toe into public sector work wit... | ||

| Flex / hybrid 2 days p/w office-based - Negotiable | ||

| P&C Consultant | ||

| London / hybrid 3dpw office-based - Negotiable | ||

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.