The headline figures released today suggest that many new pensioners have arrived in a golden age of retirement, with the average weekly income for those pensioners under the age of 75 nearly £100 a week higher than those over 75, ( £348 per week compared with £257 per week ). Even the older age group has benefitted with their average weekly income having risen by 92% since 1994/95 to 2014/2015, compared with an increase in income of less than a third (28%) for those still in work.

The latest DWP/ONS statistics also shows that 20 years ago, just 7% of pensioners worked past the age of 65, and that this figure has risen to one in eight, (13%).

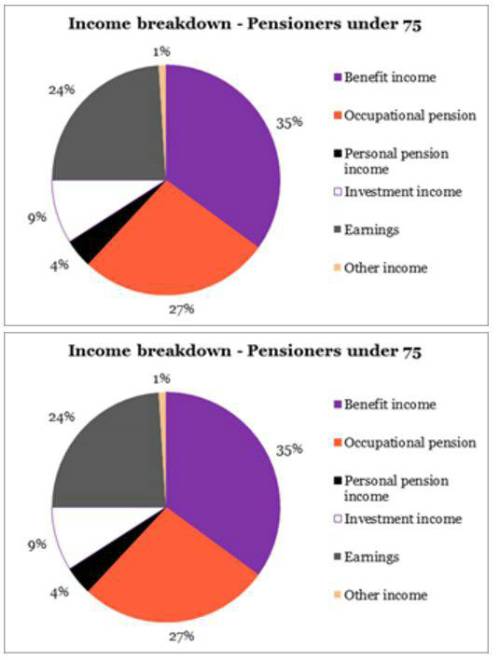

Fiona Tait, commenting on the findings, said: “The significant increase in weekly income is great news for those in retirement. But looking at the main differences in the source of income for those under and over 75, there are clearly two key elements. A smaller percentage of the income for those under 75 is being sourced from state benefits, (35% compared with 55%). By contrast, income from earnings represents nearly a quarter of the income (24%) for those under 75 compared with just 3% for the older age group.

Longer working lives look to becoming more the norm. Recent research Royal London conducted shows that working longer was ‘Plan B’ for many, particularly those who thought they wouldn't be able to afford to retire at the State Retirement Age. What it is not clear is whether these people are working because they want to, or because they have to in order to supplement their income. This suggests people may be better off with a plan that is based on a more realistic retirement age, with a contingency for not being able to work.”

Fiona continued: “Benefit income, such as the state pension, is designed to provide a basic level of income, not to replace earned income. This means that the majority of people who want to maintain their standard of living into retirement will have to make additional savings. Automatic enrolment will help those in the workplace to secure additional pension income but saving levels will almost certainly have to be higher than the bare minimum. This is where a financial adviser can help to outline the best options available and ensure that savers are not disappointed when they come to retirement.”

|