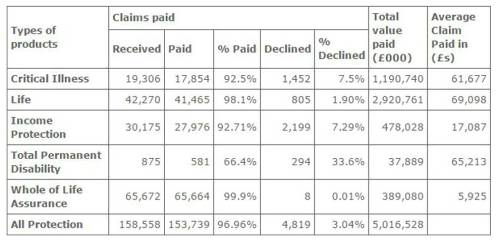

These show that insurers paid out more than £5bn last year to help people through difficult times. Products such as life insurance, critical illness cover and income protection, bought by individuals or employers protecting their staff, can help families cope with financial strains following a life changing event.

Protection industry statistics show for 2015:

-

More than £5bn was paid last year in group and individual protection insurance claims, the equivalent of almost £14m a day.

-

Protection insurers paid more than 153,700 claims in total last year.

-

Overall, 97% of group and individual protection claims are paid. When claims are declined this is usually due to either the claim being for a condition not covered by the policy, or the customer not disclosing important information when taking out the policy.

Raluca Boroianu-Omura, ABI Assistant Director, Protection and Health, said: "Insurance provides vital support to families by relieving the financial strain following a death, serious illness or injury. Products such as income protection, life insurance and critical illness can improve people’s financial resilience.

"It’s important that we encourage people to consider the financial risks if they need to leave work because of illness or injury. As well as financial support, protection insurance can help prevent people needing to leave work, and if they do need to leave due to illness or injury, rehabilitation services can help them return to work sooner. As a result, protection insurance benefits individuals and employers, and relieves the burden on the State, helping the economy to grow."

Lee Lovett, Chairman of GRiD, said: "These consolidated claims statistics show the hugely significant support that protection insurance provides for individuals and their families, whether via individual policies or cover provided by employers.

"Despite this, the major challenge for our industry is that a material proportion of the working population have no (or insufficient) cover and GRiD’s focus is on improving awareness and ultimately increasing the number of lives that have access to cover via their employer."

|