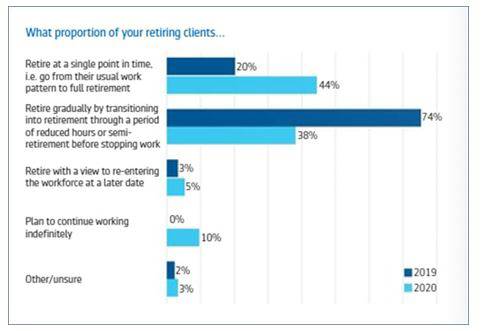

These are just two of the key factors which may have led to a dramatic reversal in the trend towards transitioning into retirement. Aegon’s recent Adviser Attitudes Report found that the proportion of advised clients retiring in the traditional manner, at a single point in time, doubled last year to 44% up from 20% in 2019.

This turnaround bucks a trend visible since the pension freedoms were introduced, of people gradually phasing into retirement. In 2019, 74% of advised clients did so, but in the most recent survey this fell to 38%.

This trend is likely down to a number of push and pull factors, with many people reassessing their priorities and some opting to retire following a loss of work. This is borne out by recent ONS data highlighting unemployment among over 50s has risen to 3.7% from 2.8% since the start of the pandemic.

It’s clear that the effects of the pandemic-induced market volatility have been most keenly felt by those who are near or at retirement and reliant on savings income to meet near-term living costs. The challenge of managing retirement income is one of the reasons that the majority of queries to advisers (64%) came from clients aged 55 or older.

Steven Cameron, Pensions Director at Aegon notes: “While the marked reversal of the previous post-Pensions Freedoms trend towards phasing gradually into retirement has taken everyone by surprise, it seems likely that - once the effects of the pandemic subside - people will revert to a more gradual transition into retirement. Accessing pensions flexibly can provide the financial means to move to reduced working hours while retaining the many benefits of still having some involvement in the workplace. Advisers can help clients navigate the complexities and benefit in the most tax-efficient way.

“Whatever else, these findings clearly demonstrate the immediate impact of the pandemic on clients’ financial plans and the important role of advisers in helping people, particularly those approaching retirement, reassess their circumstances in times of financial uncertainty.”

|