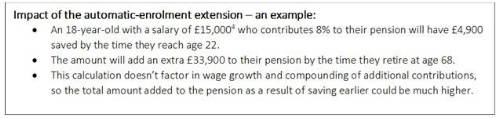

Following the passing of a new Bill in Parliament last year, automatic enrolment, which has seen nearly 11 million people start saving into a pension since 2012, is set to be extended to workers aged between 18 to 21 by the mid-2020s.

The analysis by People’s Partnership reveals that additional pension contributions of £400m per year for 18-21-year-olds will result in an additional £105bn of savings, over the next 50 years, when all returns, fees and further contributions are factored in.

Phil Brown, director of policy at People’s Partnership, said: “The earlier you can save into a pension the better as it means your money is invested for longer and has more time to benefit from growth in investment markets. So, the Government’s commitment to help younger workers start saving for their future is a huge step forward. But now we need to see promises turned into action, with a cross-party consensus on the timeline for delivering this change, given we have been waiting for this since 2017.

“Automatic enrolment is undoubtedly one of the most successful Government policies in living memory, enabling millions of people to save tens of billions of pounds extra into their pension. It’s absolutely right that the policy continues to develop so that it reaches its full potential and enables as many people as possible to have the opportunity to benefit.

“With nearly 4 in 10 people not saving enough for their retirement, the next big challenge for policymakers and the industry is reaching a consensus on how we solve the problem of under saving.”

|