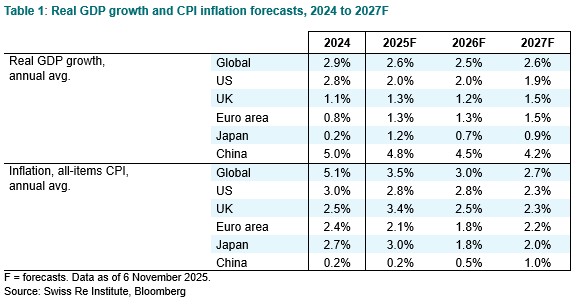

The global economy is entering the next phase of fiscal expansion and industrial policy dominance. While accommodative fiscal and monetary policies cushion growth against the impact of trade tariffs, Swiss Re Institute finds that this comes at the cost of structurally higher inflation and rising debt burdens. According to the latest sigma report "Shifting Sands", real global GDP growth is forecast to be stable from 2025, but below the pre-pandemic decade's 3.1%.

"Industrial policy is rewriting the economic playbook, AI is accelerating, growth looks strong, but the credit cycle will reveal how solid it really is. The re-industrialisation drive and technological transformation are powering activity and supporting the core of underwriting, yet headline economic growth figures mask deeper structural fragilities that will surface once the credit cycle turns. Over the shorter term, we expect the economy to navigate a soft patch, with tariffs still feeding through to prices in the US and exports globally", said Jérôme Jean Haegeli, Group Chief Economist of Swiss Re and Head of Swiss Re Institute.

An evolving political economy with heightened reliance on industrial policy is among the structural regime shifts taking hold over the longer term. The increased risk of fiscal dominance – where central banks prioritise debt stability over price stability – and sustained industrial spending will keep inflation anchored above pre-2020 norms, keeping long-dated bond yields elevated.

The US will see real GDP growth moderate to 2% by 2026 and 1.9% by 2027, while the Euro area benefits from fiscal stimulus, notably Germany’s EUR 1 trillion investment programme (2026: 1.3%; 2027: 1.5%). China’s growth will moderate to 4.5% in 2026 and 4.2% in 2027, due to still weak domestic consumption and property-linked investment headwinds and despite a more accommodative policy stance. Emerging Asia will stay resilient under flexible monetary frameworks, benefiting from trade re-routing in a fragmented world.

Structural regime shifts reshape insurance landscape

Industrial policy has returned to the core of national economic strategies. The number of government interventions in industrial sectors has tripled since 2012, spurring a global race for technological and manufacturing leadership.

While an evolving political economy with heightened reliance on industrial policy boosts domestic investment – particularly in semiconductors, AI infrastructure and defense – it also drives fragmentation and concentration risk. Industrial policy aims to build resilience but raises the risk of inefficiency, as firms accelerate a regional re-routing of supply chains, production operations and sourcing. For insurers, it means more opportunities in engineering, property and liability lines, but also more correlated exposures when shocks occur.

Population ageing is reshaping labour markets, consumption, and protection needs. Demand is shifting from family protection to longevity, retirement income and health solutions, requiring insurers to innovate and extend cover across longer lifespans. Ageing also changes asset-liability management dynamics, lengthening duration requirements and amplifying the importance of long-term solvency planning for insurers.

AI – opportunity and challenge

AI is driving direct shifts in operations across value chains in non-life and life insurance. Swiss Re Institute estimates that globally 3–8% of insurers' IT budgets have been allocated as of 2025 to develop AI capabilities, seeking operational benefits in the form of efficiency gains, time saved and workflow enhancements, yet less than 5% of insurers according to the sigma (based on a sample of 187 major insurers) have disclosed any financial impact.

In the near term, the sigma authors do not expect AI-driven labour market dislocations as most insurers aim for human workforce augmentation rather than complete automation of processes. One of the main challenges for insurers will be to model and price risks with no historical precedent while leveraging AI’s potential to improve underwriting, claims and productivity.

Insurance markets maintain robust profitability

Despite these headwinds, the global insurance industry enters this new era from a position of strength. Structural tailwinds from high long-term interest rates, demographic change and technological innovation will continue to support profitability. The sector remains well capitalised and resilient, with solvency ratios above 200% and strong liquidity buffers.

Global insurance premiums are set to grow by 2.3% in real terms in 2026 and 2027. The non-life sector is forecast to see global real premium growth easing to 1.7% before recovering to 2.5% in 2027. Profitability will remain solid, with ROE around 10.5%, supported by structurally elevated investment yields (4.3%) and disciplined underwriting.

In the life sector, global premiums will grow by 2.5% per year, up from 2.2% in 2025. Higher long-dated bond yields will underpin investment income and strengthen profitability, with the sector’s return on investment rising to 4% in 2027. Global life premium volumes are expected to reach USD 4.1 trillion by 2027, accounting for 44% of total market premiums.

|