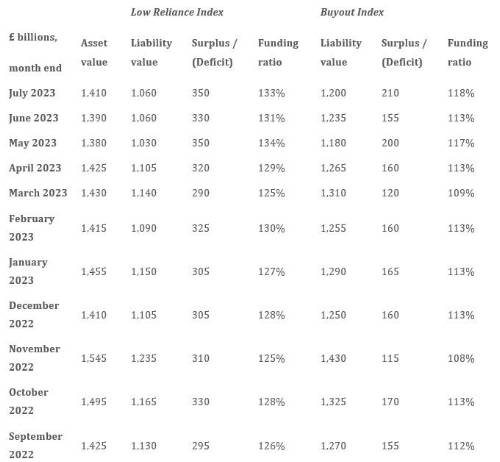

Meanwhile, the Low Reliance Index also continues to show a sizable surplus of £350bn. This index assumes schemes invest in low-risk, income-generating assets like bonds, meaning they are unlikely to call on the sponsor for further funding.

For the UK’s DB pension schemes who can’t afford to buyout, many may be looking towards Superfunds as a potential long-term solution.

John Dunn, head of pensions funding and transformation at PwC, said: “July was an action-packed month for pensions initiatives, with a number of consultations, consultation outcomes, plans and calls for evidence launched following the Chancellor's Mansion House speech. In contrast, the funding position of the UK’s DB schemes has been reassuringly uneventful; DB schemes remain well funded as has been the case for many months now.

“Among these announcements, the Department for Work and Pensions published a response to its 2018 consultation on Consolidation of Defined Benefit Pension Schemes. We agree that vehicles such as Superfunds could provide a valuable alternative to insurance for sponsors and trustees that find that full buyout is unaffordable. However, whether or not Superfunds will support the Government’s vision, to harness the substantial assets of UK pension schemes to stimulate economic growth by investing in productive assets, will depend on the risk appetite of both investors and regulators.”

Matt Cooper, head of alternative pension solutions at PwC, added: “One of the key challenges for the Superfund market getting off the ground has been the cost of transactions. Under the current regulations there hasn’t been much difference between the cost of insurance buy-in and transferring a scheme to a Superfund - so pension schemes that had been exploring Superfunds ended up going to insurers. The changes proposed in the consultation response are expected to lower the cost of transferring to a Superfund to around 90% of the cost of insurance buyout. While a lower cost may make these solutions more attractive, trustees will need to understand the level of security these solutions are now offering.

“With an increasing number of schemes exploring insurance solutions given improvements in funding, a live poll at our most recent Virtual Ideas Exchange event found that one in five pension schemes who recently approached the insurance market are now struggling to get engagement from insurers to quote for them.

“Superfunds and other Capital Backed Funding Arrangements may represent a lower cost solution for less well funded pension schemes to explore, as a means for enhancing member outcomes and allowing the employer a means to manage their legacy pension liabilities.”

The PwC Low Reliance Index and PwC Buyout Index figures are as follows:

|