Isio’s research evaluates ESG integration across asset classes, exploring developments in investment approach, risk management, stewardship, reporting and collaboration, using its proprietary Sustainability Integration Assessments (SIAs). It found continued strong progress at firm level, but some inconsistencies in how ESG is embedded, evidenced and disclosed at fund level.

The findings are particularly timely with the Department for Business and Trade currently consulting on draft UK Sustainability Reporting Standards, which closes next month.

Political pressures prompt exits from sustainability initiatives

Isio found that overall levels of ESG integration remain robust at firm level with more asset managers committing to the UK Stewardship Code (69% in 2025 vs. 65% in 2024) and Net Zero plans (65% in 2025 vs. 58% in 2024). However, due to rising political pressures, particularly in the US, there have been some withdrawals from other collaborative sustainability initiatives, with signatories to the Net Zero Asset Managers Initiative (NZAMI) decreasing from 63% in 2024 to 57% in 2025.

Reporting improves, but gaps remain in private markets

As demand for transparent and credible ESG disclosures increases, reporting practices remain under pressure. Just over half (54%) of strategies assessed provided what Isio defines as sufficient fund-level reporting. Climate-related reporting has improved, with over two-fifths (41%) of funds aligned to Taskforce on Climate-related Financial Disclosures (TCFD), including Scope 3 emissions disclosures. Social and nature-related disclosures continue to improve with 39% and 17% of funds meeting the benchmark in 2025 compared to 33% and 11% in 2024 respectively, however there remains significant room for improvement.

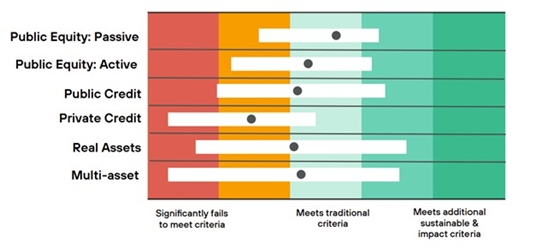

These gaps are particularly evident in private markets strategies, where data limitations and methodological inconsistencies remain key challenges. Despite this, real assets remain among the most advanced asset classes for sustainable and impact integration, reflecting the alignment between physical infrastructure and long-term ESG goals.

Managers row back from ESG objective-setting

ESG objective-setting has declined with just 39% of funds assessed adopting formal ESG objectives or focus areas in 2025, down from 49% last year. This retreat may reflect increased regulatory scrutiny, evolving labelling regimes and a desire to avoid greenwashing claims. While integration remains a core focus, the decline in forward-looking ESG ambition suggests some managers are taking a more cautious stance in a shifting policy environment.

Stewardship and risk management continue to evolve

Isio’s survey assessed how asset managers are incorporating ESG risks within investment processes. Many are now using multiple data sources and integrating ESG factors through scorecards or climate scenario modelling, particularly in active equity and real asset strategies. Three quarters (77%) of managers are using ESG scorecards and multiple data sources, up 2% from 2024, while 62% are conducting climate scenario modelling, up from less than half (49%) in 2024. However, within climate scenario modelling, challenges remain in how climate tipping points and systemic risks are captured within models.

Cadi Thomas, Head of Sustainable Investment at Isio, said: “It’s encouraging to see that progress on sustainable investing continues, even in the face of a wider ESG backlash, particularly in the US. Most firms are holding firm on their commitments, and we’ve seen positive steps forward in areas like reporting and risk management, which are key foundations for long-term integration.

“At the same time, there’s still significant work to do at fund level. Disclosures remain inconsistent, particularly in private markets, and while climate reporting has improved, social and nature-related data continue to lag. Fewer funds are adopting formal ESG objectives, potentially driven by increasing labelling scrutiny. This shift suggests a more cautious approach, likely in response to growing regulatory pressure. With sustainability reporting now firmly on the Government’s agenda, now is the time to take stock and ensure strategies can stand up to increasing scrutiny.”

|