The key statistics are as follows:

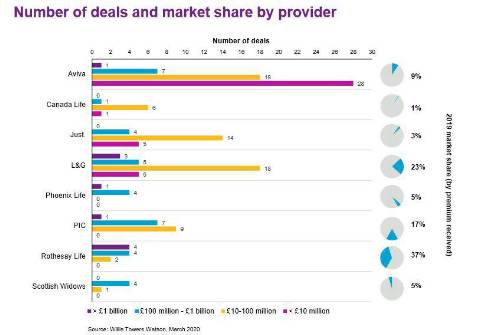

• There were a total of 153 deals (compared to 162 in 2018)

• Ten transactions over £1 billion in size – the most in any year;

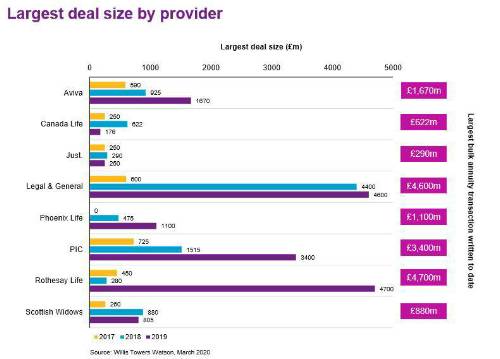

• The largest ever bulk annuity transaction – the £4.7 billion buyout of the GEC 1972 Plan;

• Six insurers wrote more business than they had in any previous year;

• Despite the number of ‘mega deals’, seven insurers wrote transactions for less than £100 million of liabilities; and

• Around 70% of the deals written in 2019 covered liabilities of less than £100 million.

Shelly Beard, Senior Director of Transactions at Willis Towers Watson, commented that: “With the significant increase in demand for bulk annuities, preparation is more important than ever, and this applies equally to small, medium and large schemes. For example, some of the very large transactions in 2019 were facilitated by the scheme having previously completed a longevity swap which could then be transferred to the insurer as part of the bulk annuity. At the smaller end of the market, schemes were able to secure attractive pricing by following a well-run and agile process. This included adopting a streamlined approach to negotiations, being flexible in the timing of execution and working exclusively with an insurer much earlier in the process, where appropriate.”

|