The net result of the annuity rate improvements means the payback period on a benchmark £100,000 annuity today is 14 ½ years, for a 65-year-old which generates an income of £6,907 a year. This compares to the same annuity paying an income of £5,240 five years ago, with a break-even point of 19 years, and the same annuity paying an income of £5,670 a year ago, with a pay-back period of 18 years.

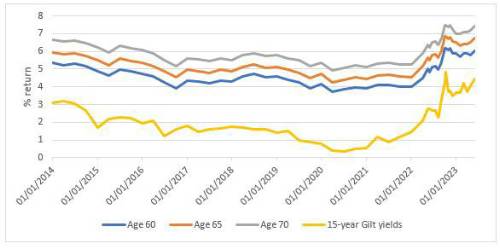

Today, a benchmark annuity for someone aged 65, with no pre-existing health or lifestyle conditions, would pay in the region of 6.9%. This annuity rate can increase significantly when disclosing common health or lifestyle conditions, such as diabetes, high blood pressure or being a smoker. Age can also have a big influence on the annuity rate offered.

Nick Flynn, retirement income director at Canada Life comments on the research: “It’s been a long time coming but annuities are firmly back in fashion, driven by the significant improvement in rates. This is evidenced by the break-even point, the tipping point at which you receive your original investment back through income. This has moved forward by nigh on five years, which shows just how much the market has moved in a relatively short space of time.

“Annuity rates are currently at levels not experienced since the banking crisis of 2008/9, which shows just how far we’ve come. It’s difficult to predict where annuity rates will go, but markets have already priced in interest rate movements, while yields on gilts have stabilised.

“Considering your retirement choices shouldn’t be a binary decision between annuity and drawdown. Rather than adopting an either-or approach, you can consider blending annuity and drawdown to provide the best of both worlds, a risk-free retirement income and flexibility. Annuities can also be bought in tranches as you move through retirement, securing a better rate as you age.

“Working with a regulated financial adviser or consulting an annuity broker will ensure you consider all of your options and keep your retirement plans on track.”

How lifetime annuity rates have changed over time

Source: Canada Life annuity rates over time, as at 01/06/20232

|