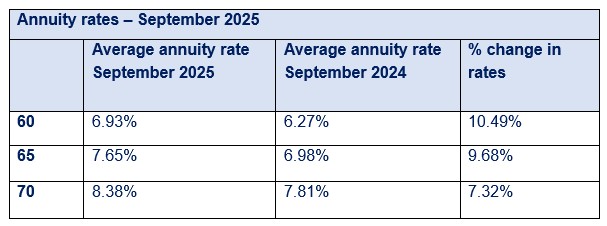

Annuity rates saw an uplift in September 2025, rising by 9.68% compared to the same period last year, according to the Standard Life Annuity Rates Tracker. The average rate reached 7.65%, supporting an annual improvement in possible retirement income year on year.

In addition, the headline rate of 7.65% represents a significant shift in retirement planning dynamics, translating to a payback period of approximately 13 years, meaning a 65-year-old retiree would begin receiving more than they initially invested from the age of 78. This is an improvement of nearly 10 years compared to when rates were at their lowest.

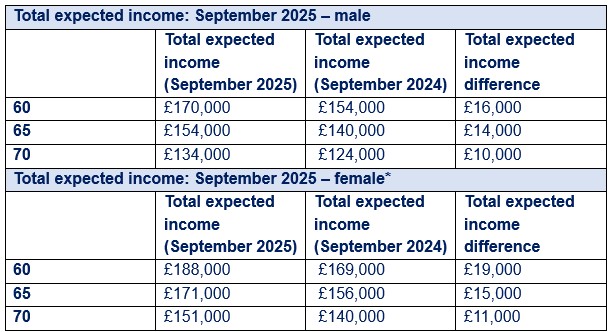

A healthy 65-year-old with a £100,000 pension pot could now expect to receive an annual income of up to £7,650 - an increase of £670 compared to September 2024, when the average rate stood at 6.98%. This could translate to an additional £14,000 for a healthy 65-year-old man, and £15,000 for a healthy woman over the course of their retirement. To illustrate the impact, that extra £670 is around the average cost for a weekend getaway for two within the UK, covering travel, accommodation, and dining.

Pete Cowell, Head of Annuities at Standard Life, said: “Annuity rates remain strong and continue to offer valuable income certainty for retirees, following a slight dip since May. Notably, at today’s rates, a 65-year-old would need to live to 78 to break even—almost a decade earlier than during the rate lows. In addition, around half of customers could qualify for an enhanced annuity, unlocking even higher income and a shorter payback period.

“Annuities remain a crucial way for retirees to ensure they get what they want from their retirement income, as research from National Annuity Day revealed that just over a third (35%) of UK adults over 50 want a ‘steady and stable’ retirement income, while an additional quarter (24%) want to always be prepared with both a regular income and reserve for bills and costs. This demand for income certainty, alongside market conditions—including economic and regulatory factors—will continue to drive demand, especially with the planned IHT changes expected in 2027, which are prompting more people to consider annuities as part of their financial planning.”

Total lifetime income

According to the Tracker, a healthy 65-year-old male who bought an annuity in September 2025 at a rate of 7.65% could expect a total lifetime income of £154,000. For a female of the same age, the expected income was £171,000.

Meanwhile, a healthy 70-year-old who bought an annuity in September 2025 could expect a rate of 8.38%. For a man, this would provide a total lifetime income of £134,000, while a woman could expect to receive £151,000.

*Based on a pension pot of £100,000. Total expected income figures are based on life expectancy statistics from the Office of National Statistics, based on age annuity is first purchased. Total expected income includes annuity income only and rounded to three significant figures.

Improving rates with age

While buying an annuity earlier in retirement can lead to a higher total income over time, annuity rates generally improve with age. This means that those who delay purchasing an annuity may benefit from more favourable rates later in retirement.

As of September 2025, rates for a healthy 60-year-old were 6.93% compared to 8.38% for a healthy 70-year-old. This results in an annual income of £6,930 for a 60-year-old versus the £8,380 a healthy 70-year-old may expect to receive on a £100,000 pension pot – a difference of £1,450.

Pete continued: “It’s important to remember that annuities offer flexibility and can be tailored to suit different retirement needs. While some people might prefer the certainty of a lifetime annuity, others might choose to keep part of their savings in reserve, and you don’t have to annuitise your entire pension pot. Meanwhile, for those who want to adjust their spending more regularly, a fixed-term annuity can provide a way to secure income over the short term, giving retirees the security of knowing their bills will be met while providing an element of flexibility.”

|