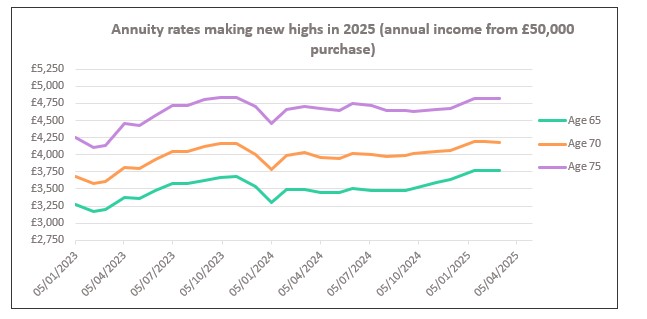

Early 2025 has seen the income available on Guaranteed Income for Life solutions rise back up to recent highs, new figures1 from retirement specialist Just Group reveal.

Annuity rates, which had slipped back from the levels seen in late 2023, have since risen back to previous high points.

Retirees can now access guaranteed income rates at 15-year highs and nearly 70% higher than the low point four years ago. A healthy person investing £50,000 of pension cash in the top-paying single-life annuity would receive annual income of £3,765 (a rate of 7.5%) at age 65, £4,175 (8.35%) at age 70, and £4,824 (9.65%) at age 75.

Stephen Lowe, group communications director at Just Group, said that attractive rates were driving up interest in annuity solutions among people keen to secure guaranteed income they know will last for their lifetime.

“Annuities give retirees the peace of mind that they can spend their income this month knowing with certainty that more is on its way next month. I think in today’s environment many people are seeing current rates as sufficient to meet their retirement objectives and a good time to lock in. Along with other sources of guaranteed income such as State Pension, it provides peace of mind that there will always be an ongoing income to cover day-to-day bills.”

He said that it was important that people choosing to access their pension benefits understand the retirement options available to them and said he strongly recommends people take the free, independent and impartial guidance from the government-backed Pension Wise service.

And for those people ready to take action, professional annuity brokers or financial advisers can help retirees choose options tailored to their own circumstances and can seek out the best deals.

“The rate that an individual will be offered is likely to vary quite significantly from the standard rates published, depending on your health history and lifestyle factors, the options you choose such as inflation-protection or continuing income to a spouse or partner.”, added Stephen Lowe.

“The key is to get the best deal you can by shopping around and disclosing any medical conditions and lifestyle factors before making the purchase, because every extra penny can contribute to thousands of pounds over the course of a long retirement.”

|