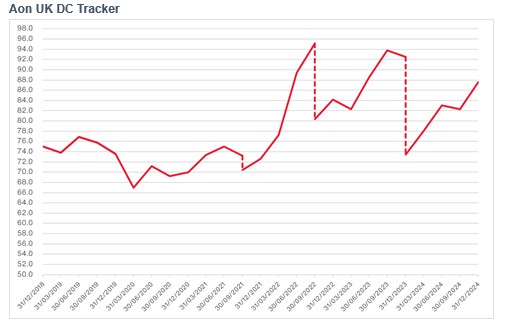

During this relatively short period (in the context of pensions savings), our savers have navigated the COVID-19 pandemic, geopolitical tensions, and periods of heightened inflation. Despite the volatility driven by these events, the Aon UK DC Tracker shows that this six-year period has been positive for our DC savers overall.

Following the original members through the whole period, rather than re-setting each year leads to the Tracker being around 12.6 points higher at 31 December 2024 than at the start of 2019. This suggests that members are now expected to have a higher standard of living in retirement than they were at the start of the period. This reflects strong benchmark asset returns over the period which are compounded year-on-year when members are not ‘re-set’.

Source: Aon UK DC Pension Tracker (31 December 2018 to 31 December 2024)

Navigating volatility is becoming the new normal

Over the six-year period, there were two notable drops in expected retirement outcomes for savers, both triggered by the release of new PLSA Retirement Living Standards (i.e. members needing a higher income in retirement to maintain the same standard of living).

In both cases, these declines followed a period of steep improvements in expected retirement incomes, reflecting the time it takes for the effects of a prolonged high inflationary environment to be fully incorporated in the Retirement Living Standards. This delayed reaction has resulted in a bumpy ride for our DC savers, highlighting the unpredictability for those planning for their future.

Matthew Arends, partner and head of UK Retirement Policy at Aon said: “With the impending introduction of pension dashboards, pension savings are going to be more visible than ever before. However, many DC savers will need education and support to make the most of this additional visibility. As the Tracker shows, inflation will substantially affect a saver’s standard of living even as their fund has grown in value - and they may think they are better off ‘on paper’ when the reality is different.

“When looked at in isolation, the last six years have shown that while overall progress was not derailed, there have been significant rises and falls in expected retirement outcomes. For DC savers, navigating these shocks has become the new normal. Rather than having the confidence to invest for the future and benefit from compounding investment returns over the long term, younger savers especially may be put off contributing if they see their pots fall in value. Predictability of retirement outcomes is an unsolved problem that the pension industry needs to address over the coming years, or savers - particularly younger ones - may conclude that it's preferable to opt-out of pensions saving.

“Navigating market volatility doesn’t just apply to DC savers in the run up to retiring, as the impacts will also be felt throughout the years for DC savers opting to remain invested through retirement and draw income retirement as needed. With more options than ever around how members access their DC funds at and through retirement, the majority of pension savers will need support to ensure they are making the right decisions for their own circumstances when they come to retire.”

How well off are you?

At the end of the six-year projection period our oldest pension saver has just reached state pension age and is assumed to retire. The Aon UK DC Tracker assumes that all our savers will remain invested and take their funds through income drawdown in retirement. Our saver could instead choose to take their full pot value as a single lump sum or use it to purchase an annuity (which provides a guaranteed income for life). In reality, the cost of purchasing an annuity has fallen drastically since 2019. This improvement in pricing could lead to more DC savers, who have seen a rollercoaster ride in their DC fund values, opting for the stable income in retirement that an annuity could offer rather than the volatility and additional risk of remaining invested.

Our oldest saver is also the only one of our savers who will be eligible for the state pension at age 66 with the younger savers having to wait until age 67 or 68 for the youngest member. The single tier state pension has increased substantially over the last six years and provides a significant proportion of the retirement income for our oldest saver. It currently provides around 80 percent of the PLSA minimum living standard, representing a valuable base income in retirement, particularly for those with limited private pension saving. The challenge remains, however, for all members with DC pensions to judge exactly how well-off or not they are against such a volatile backdrop.

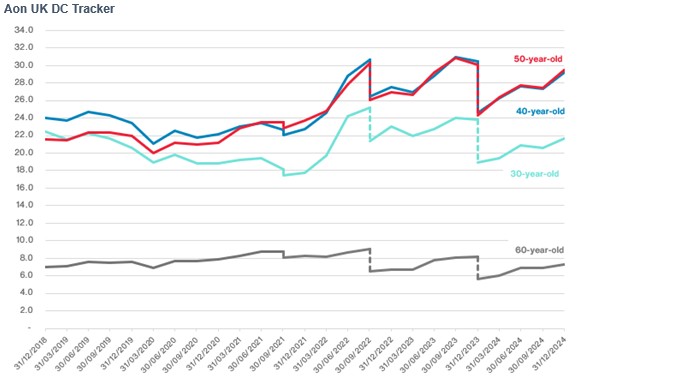

Following the same members through the whole period

In £ terms all members saw a significant increase of between £6,250 and £18,350 per year in expected retirement income over the six-year period. This increase was driven by a combination of increased income from expected pensions savings, together with increases in the state pension (which went up by £3K or 35 percent over this period).

Source: Aon UK DC Pension Tracker (31 December 2018 to 31 December 2024)

The biggest winner in both £ and percentage terms was the 50-year-old saver, as they had the highest starting fund value to benefit from the high actual returns. Despite significant volatility over the period, the returns on growth assets have been strong over the period, particularly since 2021. This most benefits those who are already asset owners, typically older savers who are further through their career and closer to retirement. Combined with the fact that older members are more likely to have built up some elements of DB pension in their career and could also have benefited from increases in the value of property assets outside of their retirement saving, there is a real risk of the emergence of an intergenerational divide in retirement outcomes.

The oldest saver reaches retirement at the end of the period

Our oldest saver’s expected income is up from £16.5K at the start to £22.8K at the end. While market conditions and favourable assumptions have contributed to this, the largest impact is due to increases in the state pension (which increased by around £3,000 p.a. over the period). This saver is set to retire at age 66, unlike some of the other savers who have to wait until 67 or 68 to receive their state pension.

Of all our featured individuals, this saver’s tracker score has remained most stable over the whole period, ending the six years, up just 0.4 points. Much of this stability is due to the relatively low level of existing pension savings assumed for this member (£80K fund at the start of the period) and the fact that the state pension makes up a high proportion of their retirement income. Significant increases in the state pension have helped to offset the significant increases in the PLSA retirement living standards. In relation to the PSLA Retirement Living Standards, our oldest saver is set to enter retirement reasonably above the minimum standard f £14,400 p.a., but the furthest from the moderate standard of all our savers. However, it is likely that they may also have a defined benefit pension elsewhere, which will also form part of their overall retirement income. By contrast, our younger savers are more likely to be part of ‘generation DC’ - with 100 percent reliance on their DC pension pots.

Youngest saver feels the impact of rising Retirement Living Standards

Our youngest saver, still 32 years from retirement at the end of the period, has seen an increase in their expected income over the period to £39.3K p.a. However, this translates to an overall fall in the DC Tracker score from 22.5 to 21.7, reflecting that increases to the retirement living standards mean their increased income will not provide the same standard of living in retirement as they previously expected. Their expected income of £39.3K p.a. would have provided them a comfortable living standard (under the original PLSA figures) but changes to the living standards now leave them almost £4K p.a. (or around £75 per week – broadly the expected cost of the weekly food shop) from a comfortable Standard.

Member by member movement

Over the six-year period.

• The youngest saver’s expected income increased by around £8.5K p.a. (28 percent) driven by positive investment performance; an increase in future expected return assumptions post-retirement and increases to the state pension. The Tracker score actually fell for this individual due to relative changes in retirement living standards.

• The 40-year-old saver saw an increase of around £16K p.a. (or 50 percent) in their expected retirement income. Again, this was driven by an increase in the expected future investment return assumptions post-retirement, actual investment performance and increases to state pension. The Tracker score increased by around 5 points for this individual and they were expected to receive income in excess of the comfortable living standard.

• Our 50-year-old saver saw the largest increase of around £18K p.a. (or 61 percent) in their expected retirement income. Due to this saver’s larger existing funds, they benefited the most from the positive investment returns, with increases to expected post-retirement investment returns and state pension also benefiting this saver. Their Tracker score increased by 8 points and they are also expected to be above the ‘comfortable’ living standard.

• The oldest savers saw an increase of around £6K p.a. (around 38 percent). This saver benefited from an increase to expected return assumptions post-retirement, together with strong investment performance over the period and the significant increases to the state pension. Despite this, there was only a minimal increase in their tracker score, as mentioned above, as a result of the increase in the retirement living standards.

• Overall, the oldest saver is expected to be the worst off in retirement, albeit with a retirement income of around 150 percent of the ‘minimum’ Retirement Living Standard. This excludes any defined benefit pension benefits they may have but which are not included in this projection.

|