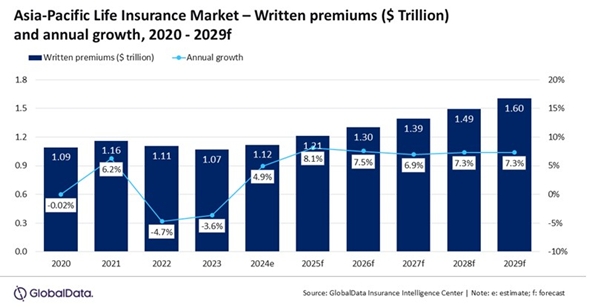

GlobalData's 2025 Global Life Insurance Market Report reveals that the APAC life insurance industry is expected to account for a 32.4% share of global life insurance industry written premiums in 2025.

Manogna Vangari, Insurance Analyst at GlobalData, comments: “The life insurance industry’s growth in this region is set to be driven by the emerging silver economy, regulatory reforms, growing high-net-worth individual (HNWI) market, and industry focus on AI platforms. Nevertheless, economic difficulties stemming from US tariff policies are expected to affect this growth.”

The APAC life insurance industry will be supported by robust growth in China and India over the next five years. The two countries, which are anticipated to record the highest growth, are the only developing markets to rank among the top 10 global life insurance markets.

Vangari adds: “China’s life insurance industry is anticipated to grow at a CAGR of 9.3% over 2025–29, increasing from $501.9 billion in 2025 to $717.0 billion in 2029. Distribution channel reforms, lower interest rate environment, and positive developments in the pension line of business are expected to contribute to this growth.”

The National Financial Regulatory Administration introduced a tiered agent system in 2024 to combat mis-selling and tailor sales practices to consumer needs. This system will take effect on February 1, 2026. Additionally, in May 2024, China imposed stricter bancassurance regulations, reducing commission rates and standardizing fees to curb excessive payouts, aiming to boost life insurers' new business sales, particularly for larger firms.

Chinese insurers have adjusted guaranteed returns on policies due to multiple interest rate cuts since 2023, shifting focus to participating plans. However, the adoption of these plans has been slow as of 2025.

Meanwhile, the introduction of private pensions in December 2024 is expected to boost China's capital markets through increased equity and bond investments. This is likely to spur product innovation and lead to more diverse investment options, such as pooled annuities and lifelong payment plans designed to mitigate risks for retirees.

In India, the life insurance industry is projected to surpass $169 billion by 2029, with a CAGR of 9.0% over 2025–29, driven by regulatory changes and increased participation from women and marginalized groups. Microinsurance is expected to remain instrumental in bridging the protection gap with the Bima Vistaar insurance plan, especially driven by a substantial workforce in the informal sector.

Favorable regulatory adjustments, such as raising the FDI limit to 100% and reducing the GST rate on life insurance to 0%, are also expected to boost life insurance premiums.

Vangari continues: “Mature life insurance markets in South Korea, Hong Kong (China SAR), Japan, and Taiwan (Province of China) are experiencing a demographic shift towards senior-focused products.”

Japan and South Korea are leading the silver economy trend, with over 20% of their populations currently aged 65 and above in 2025, as per GlobalData’s Macroeconomic Data. By 2030, this population age group is projected to reach 32.3% and 30.8% in Japan and South Korea.

Insurers are focusing on developing indexed universal life policies, legacy planning solutions, and trust-based payouts to cater to the HNWI market segment. This segment is projected to grow, with the HNWI population in China expected to increase from 4.8 million in 2025 to 5.9 million by 2029, at a CAGR of 5.5%, as per GlobalData’s Total HNW Wealth Analytics.

Vangari concludes: “Insurers who can incorporate AI throughout their operations and develop products tailored to the needs of the aging population and HNWI segment will be in the best position to seize market opportunities despite economic challenges.”

|