Are you the kind of person who sets an alarm for 5am, gets to the gym for 5.30 and ticks off a to-do list before breakfast? Or do you hit snooze several times, roll out of bed and see how the day unfolds? While personality tests and comparisons are nothing new, the Type A vs Type B personality craze has surged across social media platforms this year, with individuals worldwide labelling themselves based on their personality traits.

According to the trend, Type A individuals are highly organised, ambitious, and driven by a sense of urgency, while Type B personalities are more spontaneous, laid back, and likely to go with the flow. While this trend has largely focused on how these traits affect day to day life, its broader relevance to retirement planning shouldn’t be overlooked.

How saving behaviours today could impact your retirement pot tomorrow

When it comes to retirement planning, Type A’s are more likely to start saving into their pension early and boost their savings where possible. In contrast, those who align more closely with Type B traits may be less engaged and less inclined to see retirement saving as a priority, and as such contribute only the minimum or even consider pausing contributions in favour of immediate needs.

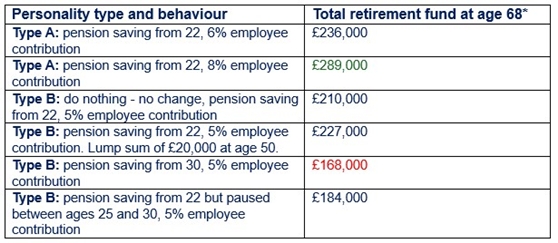

Analysis from Standard Life highlights the benefits of Type A and Type B pension behaviours on future retirement pots. Someone who begins working at the age of 22 on a salary of £25,000 a year and pays the minimum monthly auto-enrolment contributions (5% employee, 3% employer) from the age of 22, could have a total retirement fund of £210,000 by the age of 68, allowing for 2% inflation over the period.* A Type A personality who starts at the same age and on the same salary but prioritises pension saving from the start of their career, perhaps by increasing their employee contributions to 6% (9% in total including 3% employer contribution) could end up with a retirement pot of £236,000 by the age of 68 (adjusted for 2% inflation). Someone who chooses to boost employee contributions further to 8% could build up an even larger retirement pot of £289,000, in today’s prices.

Someone who takes a more laid-back Type B style strategy might be more likely to stick to minimum contributions and miss out on the larger pot. While some may plan to make up this shortfall with a lump sum contribution later in life, this strategy is unlikely to match the results of consistent saving. Indeed, an individual who contributes the minimum until age 50 and then adds a £20,000 lump sum could have a final pot of £227,000, substantially short of the £289,000 seen by individuals making a consistent employee contribution of 8%.

The cost of pausing pension contributions to prioritise spending today

With a personality trait of Type B individuals focussing on the here and now, pausing pension contributions completely could also be tempting. However, once again this can be costly for retirement pots. For example, an individual who chooses to delay pension saving until the age of 30 could end up with a retirement pot of £168,000, £121,000 lower than that of an individual paying an 8% employee contribution from the age of 22. Meanwhile an individual who decides to pause contributions between the ages of 25 and 30, could also feel the impact, ending up with a final retirement pot of £184,000 (an £105,000 reduction).

*Assumptions: Starting salary £25,000, 3% employer monthly contributions, 5% annual investment growth. Figures are reduced to take effect 2% inflation. Annual Management Charge of 0.75% assumed. The figures are an illustration and are not guaranteed. Earning limits not applied.

By delaying pension saving, individuals miss out on the power of years of potential compound investment growth. While putting money away today means there is less of it to meet near term costs, this analysis highlights the true benefits of prioritising consistent pension saving throughout your career.

Dean Butler, Managing Director for Retail Direct at Standard Life, part of Phoenix Group, commented: “While the Type A versus Type B personality trend on social media has been a fun way for people to explore their habits and quirks, it also highlights some important truths when it comes to retirement planning. Whether you’re more of an organised Type A or a more of a go with the flow Type B, understanding how your approach to saving today can impact your retirement pot tomorrow is crucial. Although putting money aside for retirement might not feel like an immediate priority, particularly for those who prefer to live in the moment, it’s clear from our analysis that a consistent less sporadic approach is likely to create good outcomes. By saving as soon as possible you improve your chances of securing the income you’ve planned in retirement, potentially adding more than £100,000 to your pension.

“Our analysis shows that starting consistent pension saving early can substantially boost retirement outcomes. For many, particularly those who lean towards a Type B mindset, pension saving can seem overwhelming or like a lot of effort, but thanks to auto-enrolment, this really isn’t the case. Often it only takes one small decision to increase your ongoing pension contributions, and from there your employer will take care of the rest. It’s a small, manageable step but has the potential to have a huge impact on your financial future.”

|