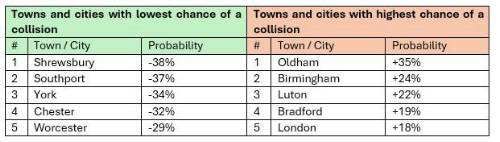

Drivers in Oldham, Birmingham and Luton are significantly more likely to be in a traffic collision than any other place in the UK. Oldham in Greater Manchester has on average a 35% higher chance of collisions and resultingly more claims on car insurance. Interestingly, the likelihood of having one here is 11% higher than in the second most likely place on the list - Birmingham.

By contrast, drivers in Shrewsbury in Shropshire are 38% less likely to be in a collision, reducing the likelihood of them making a claim on their insurance. Southport, York, Chester and Worcester also ranked low on the list.

Full results

The findings, which come from analysis through CRIF’s Traffic Exposure Score service, draws on a wide range of data sources, providing insight into the factors that can contribute to a road collision. These major risk factors include proximities to:

• Bus stops

• Tube stations

• Train stations

• Motorway junctions

• Speed cameras

• Built-up areas

Rising costs

The cost of insurance for motorists has increased by 46% in just one year from 2023, with the Association of British Insurers (ABI) announcing plans to work with the industry to bring down costs.

To develop the most accurate premiums, insurers will usually estimate the risks of driving in certain areas. However, with CRIF’s Traffic Exposure Score the ability to access and analyse more factors and data points helps to reduce costs for certain drivers, as it helps insurance companies create a more accurate view of the risks motorists may face, in turn helping prevent those drivers who are lower risk from paying higher than necessary premiums.

Sara Costantini, CRIF’s Regional Director for the UK & Ireland, said: "Our research paints a clear picture of where drivers are more likely to experience a traffic collision. Motorists in areas like Oldham, Birmingham, and Luton will see themselves at the highest risk of a collision. By contrast, towns like Shrewsbury, Southport, and York offer some of the safest roads in England and Wales.

“However, this doesn’t always translate into tailored premiums. With the cost of insurance skyrocketing in recent times, it’s more important than ever for insurers to take account of as much granular data as possible. By doing so, they can create a more precise assessment of our roads and offer fairer premiums for motorists”.

Reducing loss ratios

CRIF’s Traffic Exposure Score service only requires an insurer to provide a postcode for where a driver lives. With that it can provide a granular geographical score (from 1-14, where higher numbers mean higher risk), based on factors such as:

• Density of traffic-related points of interest (like nearby tube stations, bus stops and crossroads).

• The socio-demographic profile of the residents (which affects car protection levels).

• Other variables such as the make-up of the area (city centre, suburbs, industrial, etc.).

Having previously launched in other European countries, Traffic Exposure Score can help insurers to reduce their loss ratio by between 1.5% and 2.5%.

|