Torridge, in Devon, is the local authority with the cheapest car insurance quotes, a new study by Forbes Advisor reveals.

The study selected one random postcode from each area in the UK and used them to help find the annual premiums for a 33-year-old teacher with 10 years of no claims, driving a 2023-registered Ford Fiesta.

The comparison site data found that Torridge has the best average of the three cheapest quotes found, which amounts to £519.48.

Two Lincolnshire areas, Lincoln and South Holland, occupy second and third place with average insurance quotes of £527.70 and £540.03, respectively.

Further down on the list is Denbighshire, in Wales, which takes fourth place with an average quote of £556.44, while Richmondshire, in North Yorkshire, is fifth with £556.65.

Top 10 local authorities with the cheapest car insurance quotes

Source: Forbes Advisor

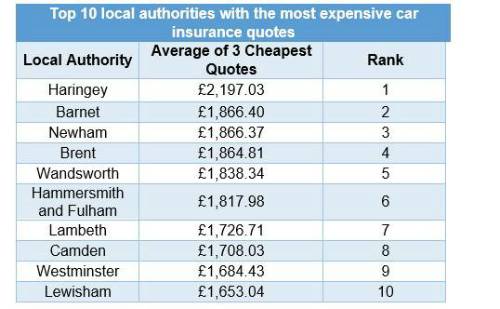

At the other end of the scale, the London Borough of Haringey totals the most expensive average of quotes at £2,197.03.

This is followed by Barnet and Newham, both also London boroughs, with average quotes of £1,866.40 and £1,866.37, respectively.

Top 10 local authorities with the most expensive car insurance quotes

Source: Forbes Advisor

Kevin Pratt, car insurance spokesperson at Forbes Advisor, said: “It’s interesting to see how much prices for car insurance change throughout the UK. If plotted on a map, the areas that occupy the top 10 cheapest quotes list are widely spread across the country.

“On the other hand, all the local authorities where car insurance is most expensive are London boroughs, which underlines how expensive it is to live in the capital.

“Wherever you live, if you’re a driver, car insurance is a legal requirement. When considering your options, it’s important to remember that the cheapest premiums might not provide the level of cover that you need.

“There are other factors to consider beyond price, such as how an insurer treats its customers and handles claims. That’s why it’s always worth taking the time to consider which providers will offer you the best value cover.”

The study was conducted by Forbes Advisor, whose editorial team boasts decades of experience in the personal finance space. It is passionate about helping consumers make financial decisions and choose financial products that are right for their life and goals.????

|