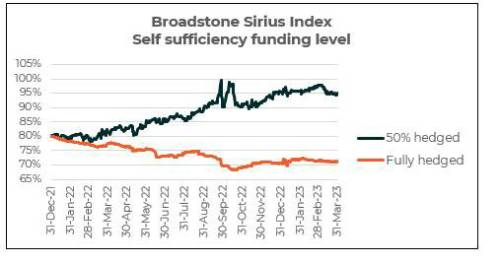

The Broadstone Sirius Index – a monitor of how various pension scheme strategies are performing on their journeys to self-sufficiency – posts its latest update.

The Broadstone Sirius Index found that falling gilt yields through March, arguably caused by the shifting view that central bank interest rate hikes will be less extreme due to the banking crisis, increased deficits in the schemes monitored, though the fully hedged scheme’s funding level remained relatively stable.

Schemes that de-risked in the last quarter of 2022 will be seeing the fruits of this with the fully hedged scheme outperforming the half-hedged scheme for the first time since interest rates started to rise significantly last year.

Gilt yields fell over the month of March and with growth assets remaining relatively flat, assets, liabilities and therefore deficits have increased. The combined impact of these changes was for our fully hedged scheme to maintain its position versus a deterioration in funding level for the 50% hedged scheme.

Overall, both schemes end the quarter in deficit and in funding level terms in a similar state as they entered it.

Marc Devereux, Head of Investment Consulting services at Broadstone reminded Trustees of the benefits of hedging and the importance of reviewing hedging levels.

He commented: “March demonstrated the benefits of a hedged position, with those schemes that de-risked at the end of 2022 now benefiting from a more stable funding position.

“However, the rapidly changing environment, which the recent market concerns over the banking system have exacerbated, highlights the importance of regular monitoring of hedging positions and funding levels. This enables Trustees to react quickly, if necessarily, to reposition their strategies and respond to potential opportunities.”

|