Annuity rates continued their upward trend at the end of 2025, rising to 7.51% for a healthy 65-year-old, a 5.48% increase on the December 2024 rate of 7.12%, according to the Standard Life Annuity Rates Tracker.

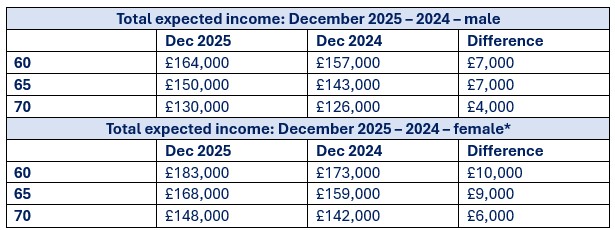

For someone retiring with a £100,000 pension pot, the uplift in annuity rates in 2025 means they could have secured income up to £7,510 per year, up from £7,120 a year earlier. Over the course of retirement, this equates to an additional £7,000 - £9,000 in expected total income.

Pete Cowell, Head of Annuities at Standard Life, said: “Annuity rates have been trending upwards over the past couple of years, giving retirees a welcome boost. These latest figures show that the rates people can secure today are meaningfully higher than a year ago, offering something we know many retirees value: income certainty and the reassurance that their income will last for the rest of their lives. At a time when market volatility can feel unsettling, annuities provide a level of certainty and long-term stability that helps people retire with greater confidence.”

Total lifetime income**

According to the Tracker, a healthy 65-year-old man who bought an annuity in December 2025 at a rate of 7.51% could expect a total lifetime income of £150,000 while a woman could expect £168,000, reflecting longer average life expectancy. At age 70, the annuity rate rises to 8.25%, generating expected lifetime incomes of £130,000 for men and £148,000 for women.

**Total expected income figures are based on life expectancy statistics from the Office of National Statistics, based on age annuity is first purchased. Total expected income includes annuity income only and rounded to three significant figures.

Improving rates with age

While buying an annuity earlier can result in higher overall lifetime income, annuity rates generally increase with age. As of December 2025, a healthy 60-year-old could secure a rate of 6.74%, compared with 8.25% for a healthy 70-year-old. This means a 70-year-old with a £100,000 pension pot could receive around £8,250 annually, compared with £6,740 for a 60-year-old — a difference of £1,510 in yearly income.

Pete continued: “As annuity rates have improved, more people are taking a fresh look at how these products can support their retirement plans, bringing certainty to this next phase of life. In addition, many may wish to use an annuity with more flexible options, like drawdown. This can create a balance of security and freedom and can be a simple way to make sure some of your essential spending is covered for life, while keeping flexibility for everything else. Ultimately, it’s key to review all options when approaching retirement, and remember you can always seek advice or guidance to help make the best choice for your circumstances.”

|