ESG is a leading theme within the industry for which brokers and insurers will need to have clear strategies to continue to attract customers, but it is not yet vital while completing partnerships, says GlobalData, a leading data and analytics company.

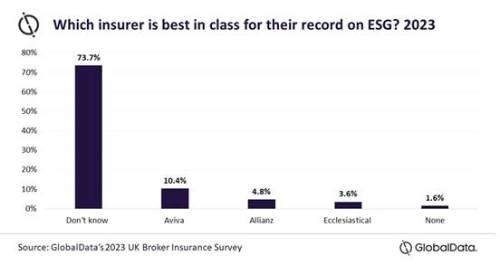

GlobalData’s 2023 UK Broker Insurance Survey* found that when asked to select the best in class for the ESG theme, only 24.7% of respondents could. Just under three quarters (73.7%) said they did not know (1.7% actively chose ‘none’). The leader was Aviva, though it received just 10.4% of total responses.

Ben Carey-Evans, Senior Insurance Analyst at GlobalData, comments: “This level of uncertainty suggests that brokers do not consider ESG to be essential when working with insurers, as very few brokers are able to identify insurers who are strong in the area.”

Furthermore, when asked for factors behind choosing to work with an insurer, being strong in ESG received no responses. The top answers for this question were flexibility in underwriting cover (23.5%), claims service quality (19.9%), price of premiums (17.9%), the quality of the insurer’s product material (8.0%), and speed of response to queries/quotes (7.6%). This shows that day-to-day business concerns are still far more important than the more long-term ESG theme in the eyes of brokers.

Carey-Evans concludes: “It will be difficult for ESG to ever be as important to brokers as these immediate factors, but our data shows that any insurer still has a clear opportunity to establish itself as a leader. Brokers not being able to pick clear leaders within this critical theme suggests that anyone who prioritizes it can stand out in the theme relatively quickly. The more innovation and progress that brokers see from insurers, the more likely they are to prioritize it as a factor in building relationships, especially as the theme is only going to grow in importance.”

* GlobalData’s UK Insurance Broker Survey was conducted in Q1 2023 with 250 respondents

|