Many people make resolutions for the new year, whether it’s hitting the gym, eating more healthily, or learning a new skill. However, one of the most powerful resolutions you can make is financial - reviewing your regular payments. The average Brit wastes £39 a month1 on direct debits they no longer need - Standard Life analysis shows that cancelling unused direct debits and redirecting that money into your pension could mean up to £37,000 extra for your future.

The potential benefit of scrapping unwanted direct debits

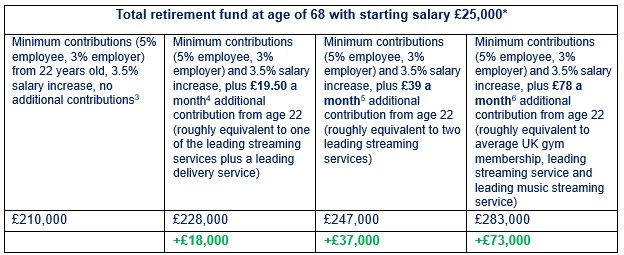

Standard Life analysis finds that someone who began working at age 22 with a salary of £25,000 and paid the minimum monthly auto-enrolment contributions (5% employee, 3% employer) from the age of 22, could build a total retirement fund of £210,000 by the age of 68. However, redirecting £39 of unused monthly direct debits into their pension - roughly the equivalent of leading streaming services2 at £18.99 and £14.99 today - could increase the projected fund to £247,000, £37,000 more in today’s prices.

The benefit could be even greater for those with more direct debits on the go. Someone who spends double the amount on wasted direct debits - £78, roughly the equivalent of an average UK gym subscription (£47.24), premium video streaming (£18.99) plus premium music streaming (£12.99), could see a boost of £73,000 in today’s prices.

*assuming 3.50% salary growth per year, and 5% a year investment growth. Figures allow for 2% inflation. Direct debits increase by 2% in line with inflation. Annual Management Charge of 0.75% assumed. The figures are an illustration and are not guaranteed. Earning limits not applied.

Mike Ambery, Retirement Savings Director at Standard Life says: “Unused direct debits have a habit of quietly draining our bank accounts in the background. The new year is often a time people focus on their physical health, but it’s also the perfect moment to think about your financial wellbeing too. Redirecting just a few of those forgotten payments into your pension could make a meaningful positive impact to your financial future. However, it is important to double check terms and conditions of cancelling any direct debits or subscriptions to avoid potential penalties or impact on your credit scores.”

“If your retirement is decades away, pensions might not feel urgent but small changes made early on can have an outsized impact thanks to tax relief and the potential power of compound investment growth. A financial reset in January can make a meaningful difference to the income you’ll have in later life.”

Mike Ambery’s top tips to get to grips with your pension in 2026:

Know the value of your pension: “Many people have only a vague idea of how much is sitting in their pension. Taking a few minutes to check your latest statement - or log in online - can be eye-opening. Once you know where you stand, it’s much easier to judge whether you’re on track or need to make changes. Pension calculators can also help turn today’s savings into a clearer picture of your future income.”

Consider a top up or adjust for any changes: “If your projected retirement income isn’t quite where you’d like it to be, even a modest monthly increase can help. Consider whether money freed up from cancelled subscriptions be redirected into your pension instead.

“It’s also worth reviewing how and when you plan to retire. Many people don’t realise you can usually access workplace and private pensions from age 55, rising to 57 from 2028. Just be aware that taking money out early can affect how much you’re able to save in future.”

Make the most of tax relief before April: “With the end of the tax year approaching, it’s worth checking whether you can make your money work harder. Most people can contribute up to £60,000 a year, or 100% of their earnings if lower, into their pension and benefit from tax relief.

“You may also be able to ‘carry forward’ unused allowances from the last three years. This can be particularly helpful if you’ve had a pay rise, a bonus, or some spare cash you’d like to put towards your future.”

Track down old pension pots: “Just like it’s easy to lose track of time between Christmas and new year, it can be easy to lose track of your pension plans. Make sure you know where to find your old plans. You can use the government’s Pension Tracing Service to help you hunt down any you might’ve lost track of. Once you’ve found them, keep your paperwork and pension admin organised and in a safe, easy-to-access place. Staying on top of this now will save you time and stress later.”

|