Despite Capital Gains Tax (CGT) receipts undershooting the Autumn Budget forecasts and a £20 billion downgrade to the Capital Gains tax-take predicted over the rest of the decade announced at the Spring Statement, there is still significant demand for financial planning and advice services for HNW and UHNW clients, according to Utmost Wealth Solutions.

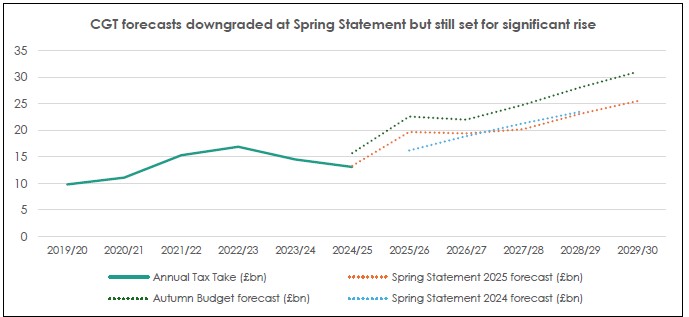

The leading provider of insurance-based wealth solutions found that CGT receipts for the 2024/25 Tax Year (£13.1 billion) had come in £2.6 billion below the Office of Budget Responsibility’s (OBR) 2024 Autumn Budget’s forecast of £15.7 billion. Moreover, the OBR’s estimates at the 2025 Spring Statement found that CGT receipts over the remainder of the decade (2025/26 to 2029/30) would come in £20.6 billion under the forecasts made just a few months prior at the Autumn Budget. The OBR states that this predominantly driven by “updated data on the composition of liabilities” with a smaller impact from the re- classification of some carried interest receipts to income tax.

However, CGT is still estimated to raise £25.5 billion by 2029/30 – nearly twice current levels – as the wealth transfer accelerates and the Autumn Budget reforms begin to impact receipts. The Autumn Budget 2024 increased the main CGT rates from 10% and 20% to 18% and 24%, respectively, effective 30 October 2024, with phased rises for Business Asset Disposal Relief and Investors’ Relief to 14% in April 2025 and 18% in April 2026, and a hike in carried interest tax to 32% from April 2025.

Simon Martin, Head of Technical Services at Utmost Wealth Solutions, commented: “Given the significant reforms to the Capital Gains Tax regime, the most recent data will be a disappointment for the Treasury’s revenue-raising ambitions. The Capital Gains tax take for 2024/25 fell short of predictions at the Autumn Budget while the Spring Statement significantly downgraded its estimates by over £20 billion for the remainder of the decade. Meanwhile, there are continued reports of wealth flows out of the United Kingdom as well high-profile exits from wealthy individuals. The latest updates from the OBR at the 2025 Spring Statement put CGT receipts on a similar trajectory to the 2024 Spring Budget so there are serious questions around whether Chancellor Reeves’ Autumn Budget reforms will achieve their stated aims. Nonetheless, we are still seeing significant and growing demand from clients for financial planning and advice services. CGT receipts are still predicted to nearly double by the end of the decade and HNWs will be keen to understand whether and how the new regime will impact them.”

|