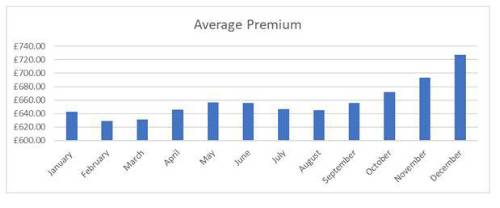

December has consistently been the most expensive month to buy insurance over the past seven years, with an average premium of £726, almost £100 more than February.

Pricing for insurance is based on a wide range of risk factors, including annual mileage, make and model of the vehicle and previous claims history. Once these have been considered, additional discounts could also be applied in order to attract customers. This ‘dynamic pricing’ model means that the cost of insurance may change throughout the year depending on the level of demand at that particular time.

Driving has become increasingly unaffordable for many people – particularly groups where insurance costs are highest, such as young drivers. Almost half of drivers between the ages of 17 – 24 say that they received financial support from their parents towards their motoring costs over the last 12 months – receiving an average of £485. According to the research, 83% of the age group said that their pay cheques were not high enough to cover the cost of driving, whilst 63% said if motoring costs continued to rise, they would no longer be able to afford to run a car.

Dan Hutson, Head of Motor Insurance, comparethemarket.com, said: “Insurance is a complicated business and providers judge the cost of a policy on a wide array of factors. However, this data clearly shows that prices change depending on which month you buy insurance. The figures imply that you could save almost £100 if you were to buy a policy in February vs. December. With the cheapest month now ahead of us, consumers should take advantage of the potentially cheaper prices and switch to a more competitive deal.

“This is particularly important for younger people who already pay, by far, the most for car insurance. It is essential that this age group takes the time to switch providers to make the cost of insurance more affordable. If 83% of young people can’t afford the cost of driving with their current pay, something has to change urgently.”

|