Until now, unspent pensions were typically passed on tax-free if the saver died before age 75, and especially before they could access them. HMRC has now confirmed that from April 2027, pension savings will count towards a person’s estate for IHT purposes regardless of age at death, unless covered by existing exemptions. This means that cohabiting families with young children, who do not benefit from the spousal exemption or a transferable nil-rate band, will be far more exposed.

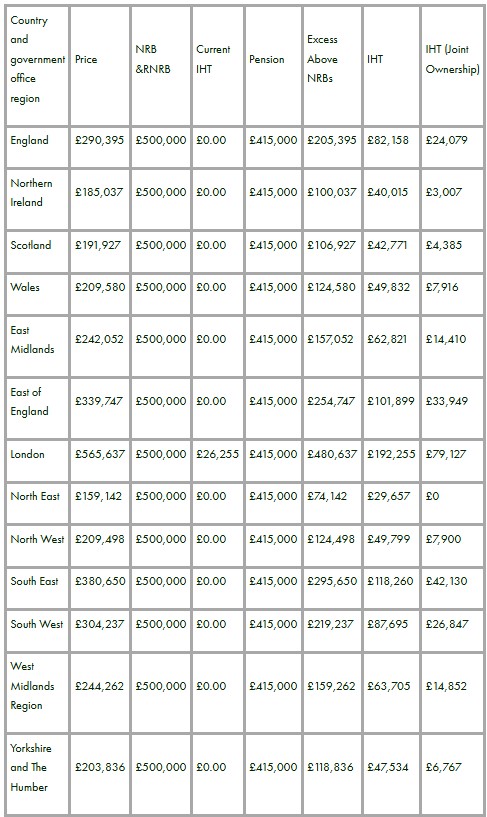

In many cohabiting households the property is jointly owned (joint tenants), meaning only half its value is included in the estate. Even then, a typical family in England would still face an IHT bill of £24,079, purely because of the pension inclusion. Where the property is solely owned by the deceased, the bill is more than three times higher.

For example, in London, sole ownership of an average-priced home (£565,637) plus a £415,000 pension creates an IHT bill of £192,254 in 2027. If the home is jointly owned, that falls to £129,127 – still a severe hit for a grieving family without the protections available to married couples.

Across Wales, Scotland and Northern Ireland, where lower house prices meant there was previously no liability for families with similar pensions, bills in joint-ownership cases will still be £23,891, £21,392 and £20,007 respectively.

These liabilities will grow if house prices inflate before the rules take effect.

Jon Greer, head of retirement policy at Quilter, said: “Charging inheritance tax on a pension someone could not access and will never be able to use due to passing away before the minimum pension age is optically terrible for the government. It is even more unjust for cohabiting families who have no spousal relief or ability to transfer tax allowances. A grieving family with young children and an average priced home could face six-figure IHT bills at the most distressing time. Married couples are protected by exemptions and allowances; cohabitees aren’t. Policymakers should consider carve-outs or transitional reliefs for working-age deaths, particularly when young children are involved. Without change, this policy risks compounding the emotional toll of bereavement with a financial hit that can destabilise a family’s future despite raking in very little in additional revenue.”

|