1 in 6 businesses (16%) applied to Aviva for a workplace pension after their staging date had passed – up from 14% in the previous quarter

A quarter of companies (25%) are making preparations more than two months in advance, but this is the lowest on record

In Q1 2017, 1 in 6 (16%) companies set up their pension scheme with Aviva after their staging date – the date the Pension Regulator says they should have a scheme in place. That is up from 1 in 7 (14%) during the previous quarter and 16 times higher year-on-year - although the number of companies going through auto-enrolment has greatly increased since the middle of 2016.

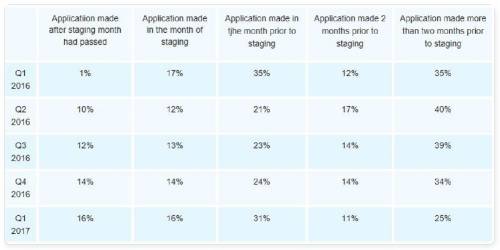

These companies are putting themselves at risk of a fine and are limiting themselves when it comes to choosing a pension scheme as not all providers will take on ‘late stagers’. The table below details the proportion of workplace pension applicants to Aviva who applied during 2016 and Q1 2017 in comparison to their staging month.

Drop in advance applications

The data has also highlighted that the proportion of firms preparing for auto-enrolment well in advance has continued to fall. Only a quarter of firms applied to Aviva more than two months in advance of their staging date – the lowest on record.

This figure is down considerably on the high of 40% back in Q2 2016. However, the proportion of companies applying a month or two months before their deadline has remained stable.

A big year for auto-enrolment

2017 is arguably the biggest year for auto-enrolment since roll-out began in 2012. Around 500,000 companies, largely SMEs (small and medium sized enterprises) are due to go through the process this year.

The number of firms who are now setting up workplace pensions for the first time does go someway to explaining to continued rise of ‘late stagers’.

Andy Beswick, MD Business Solutions at Aviva, said: “While some of these numbers are disappointing, it’s not unexpected. SME’s tend to be less well resourced and aren’t blessed with large HR departments or budgets to help them through their auto-enrolment journey.

“What the figures do highlight is that there is still work to be done to make business owners aware of their obligations. As an industry, we’ve been talking about auto-enrolment since the early 2000s and implementing it for over four years now. But to thousands of employers and employees, it is still a brand new concept and we need to make sure people aren’t getting left behind.

“We’re working hard to make it as easy as possible for SMEs to get their pension scheme in place even if they are late. Our process is online, and can be completed in 10 minutes. If employers need more support our teams are ready to offer help.”

|