|

|

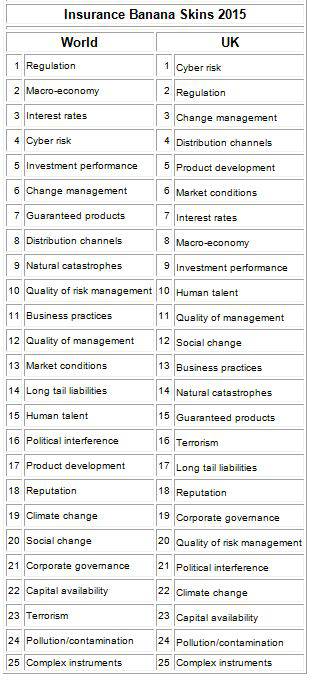

Cyber risk tops the list of concerns for UK insurers, according to the annual ‘Banana Skins’ survey of perceived risks to the sector by the Centre for the Study of Financial Innovation (CSFI) and PwC. The UK insurance industry shares the global concern about burgeoning regulation, particularly its cost and distraction, but also its potential to damage the international competitiveness of London as the world’s insurance capital if it is heavily “gold plated”. |

By contrast, UK concern about the macroeconomic situation and the outlook for interest rates is much lower than the global average.

The outlook for investment performance is also seen to be stronger by UK insurers

Most of the risks in the Top 10 centre on the rapidly changing insurance risk landscape and the new challenges facing the industry: cyber risk, the reshaping of distribution channels with the emergence of new technology and the demand for new-style products. The ability of the industry to handle these changes is, itself, seen as a high risk: "Change management" is the third biggest worry for UK insurers, and concern about the industry’s ability to attract talent is also higher than the global average.

Stephen O’Hearn, PwC global insurance leader, commented:

“The long-term prospects for the insurance sector are positive as people around the world live longer and have more wealth to protect. Yet insurers also face the disruptive impact of new technology, changing customer expectations, more exacting regulation and enduring economic uncertainty.”

Mark Train, PwC global insurance risk leader, commented:

“The ability to identify and manage emerging, as well as familiar, risks is at the top of the boardroom agenda and will be one of the key differentiators for success in a marketplace that offers considerable long-term opportunities, but also disruptive threats.”

|

|

|

|

| Senior Pricing & Portfolio Management... | ||

| London - £150,000 Per Annum | ||

| Pricing Transformation Lead | ||

| London - £85,000 Per Annum | ||

| Lead Capital Actuary | ||

| London - £150,000 Per Annum | ||

| Take the lead on capital oversight | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Be at the forefront of creative GI co... | ||

| London/hybrid 2-3dpw office-based - Negotiable | ||

| Remote Market and Credit Risk Calibra... | ||

| Remote - Negotiable | ||

| Contact us about a Capital Contract i... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Head of Insurance Risk | ||

| London - £160,000 Per Annum | ||

| Director - Pensions Risk Transfer (PRT) | ||

| London, Midlands, North West - hybrid working 2dpw in the office - Negotiable | ||

| Dip a toe into public sector work wit... | ||

| Flex / hybrid 2 days p/w office-based - Negotiable | ||

| P&C Consultant | ||

| London / hybrid 3dpw office-based - Negotiable | ||

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.