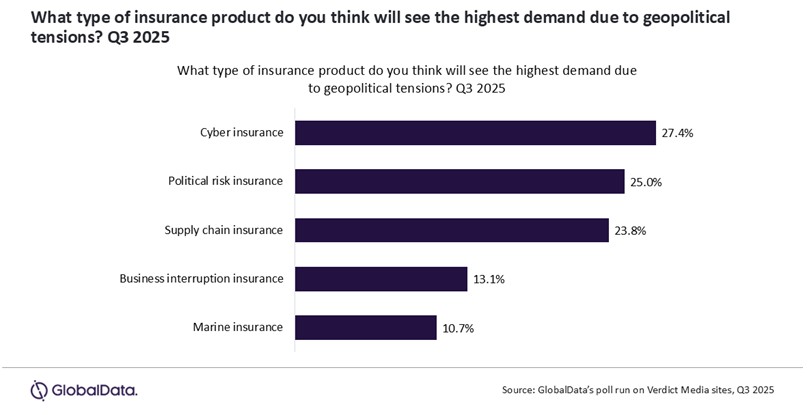

The poll, run across GlobalData’s Verdict Media sites during Q3 2025, and had 84 responses, found that 27.4% of industry insiders believe cyber insurance will see the highest increase in demand. This places cyber ahead of political risk insurance (25%), supply chain insurance (23.8%), and business interruption insurance (13.1%). The findings suggest digital security concerns are now outpacing more traditional political and operational exposures.

Charlie Hutcherson, Insurance Analyst at GlobalData, comments: “The ongoing conflict between Russia and Ukraine has expanded from conventional battlegrounds into coordinated cyber operations aimed at critical infrastructure and corporate networks. Meanwhile, the growing unrest in the Middle East has contributed to a rise in state-sponsored and hybrid cyberattacks that stretch well beyond localized warzones. Organizations are recognising that cyber incidents increasingly stem from geopolitical escalation and nation-state actors rather than isolated criminal groups.”

These threats can disrupt supply chains, weaken operational resilience, and significantly damage reputations. Such complexities highlight limitations within traditional insurance offerings and reinforce the growing role of cyber insurance as a strategic risk transfer solution.

Hutcherson concludes: “Digital threats are evolving alongside political instability. Insurers are facing growing demand for cyber products that are clearer in coverage and more active in supporting resilience, from real-time threat monitoring to faster post-breach recovery. With budgets tightening across many sectors, buyers will seek policies that deliver tangible value before and after an incident occurs. Insurers that collaborate closely with governments and cybersecurity specialists, while strengthening preventative measures such as vulnerability assessments and employee training will be best placed to retain and grow cyber customers. As geopolitical risks continue to move online, cyber insurance will remain a critical tool for protecting organisations from the full scale of emerging threats.”

|