Trustees of UK defined benefit (DB) pension schemes pursuing a buy-in or buy-out strategy are making steady progress towards their endgame goals, with close to one fifth of schemes reporting no barriers to executing their plans.

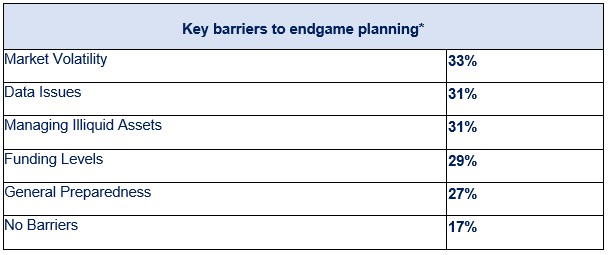

New research from Standard Life, conducted among 100 DB trustees managing schemes with assets of £100 million or more, shows a continued positive shift in sentiment and a significant reduction in perceived barriers to buy-in and buy-out activity. While confidence is improving, challenges persist, with one-third of trustees highlighting market volatility (33%) and illiquid assets (31%) as key concerns.

Endgame Planning:

Market volatility and illiquid assets remain key challenges

Market volatility remains the most significant challenge for trustees contemplating endgame strategies, driven by uncertainty around interest rates, gilt yields, and market timing. Illiquid assets also continue to demand trustees’ attention, as schemes seek to optimise portfolios and align their holdings with liquidity requirements. Trustees are deploying a range of strategies – including secondary market sales, sponsor loans, and deferred premiums – in order to manage exposure effectively and ensure readiness for buy-in or buy-out.

While data issues remain a concern for nearly one-third (31%) of the trustees surveyed, more than four in five (83%) have already completed or are undertaking a data cleanse, with a further one-in-eight (13%) planning to do so.

Claire Altman, Managing Director – BPA & Individual Retirement, said: “While the industry debate around the option of DB scheme run-on and surplus extraction continues to attract attention, our research shows that trustees remain focused and are demonstrating growing confidence as they move closer to their endgame goals. While challenges such as market volatility and illiquid assets remain, many schemes are increasingly well-prepared to manage them. We’re seeing a more strategic and collaborative approach, with trustees strengthening governance, refining investment strategies, and engaging with advisers and insurers earlier in the process. This growing preparedness is translating into steady, tangible progress across the market.”

Funding strength and insurer confidence continue to build

Nearly one-in-three (29%) trustees still express concerns about funding levels, and a similar amount (27%) cite general preparedness as a barrier. However, stronger market conditions and improved investment performances are helping schemes progress, with around one-in-ten (9%) expecting their funding position to improve or remain stable over the coming year.

These improvements are enabling more trustees to accelerate endgame timelines and focus on execution. Confidence in insurer engagement is also strengthening, supported by expanding capacity and smoother transactions processes.

With nearly half of schemes are targeting a buy-in or buy-out as their endgame strategy, over two-thirds (70%) of these are planning to approach an insurer for buy-in within the next three years – and two-fifths (40%) are intending to do so within the next twelve months. Early preparation will remain key to maintaining momentum and securing capacity.

Claire Altman continued: “Schemes that act early and take advantage of their current funding strength will be in the best position to move decisively when market conditions align. Acting from a position of readiness enables trustees to move quickly and confidently when the time is right. The market is evolving rapidly, and well-prepared schemes are now shaping its direction. Those that plan early, stay engaged, and act decisively will be best placed to complete their endgame journey and deliver long-term security for their members.”

|