Sarah Abraham, Head of Redress Services at First Actuarial, says: “Our modelling continues to show that the vast majority of consumers will not have suffered a loss as a result of transferring out their DB pension. As a result, they will not be due any redress. Overall, therefore, redress payments will remain low despite recent market shifts that will slightly increase the compensation due to those people who did suffer a loss”.

Personal investment firms that have provided advice on DB transfers had already received good news in December 2025 with the FCA’s announcement that it will not be implementing capital deductions for redress.

Under the FCA’s original proposal, firms would have had to quantify potential redress payments and set aside capital accordingly. There would also have been new reporting requirements.

Sarah explains: “The FCA recognises how important it is to prevent firms from walking away from their redress liabilities, and has issued several communications to support this objective. Although the proposal to explicitly set aside capital for redress will not be implemented, firms will still have to comply with this ‘polluter pays’ guidance, and may therefore want to understand their potential exposure to redress payments.”

Sarah concludes: “We continue to see M&A due diligence processes identifying the risk of future redress payments arising from pensions transfer advice. Firms looking for a purchase should therefore take a close look at their book of transfer advice. And firms should consider Defined Contribution transfer advice as well as DB, because we continue to see compensation being required in relation to the former”.

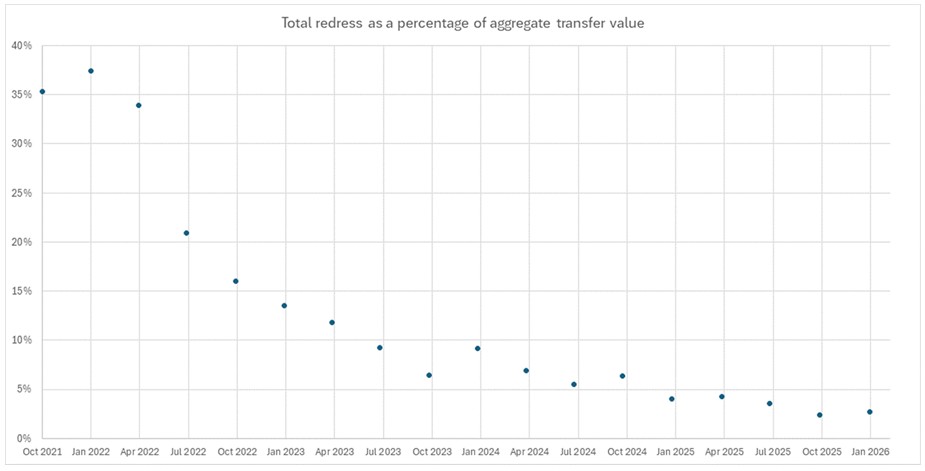

First Actuarial Redress Tracker as of 1 January 2026

Because DB redress payments are measured using market conditions on the first day of each quarter, any calculations carried out before April will reflect circumstances as at 1 January 2026.

The First Actuarial Redress Tracker, now updated to 1 January 2026, models the aggregate redress for a portfolio of notional cases. The notional portfolio reflects redress in relation to transfers from a variety of schemes, with a range of transfer dates and consumer ages. Allowance is made for transfer proceeds to have been invested in a mixed portfolio of assets.

|