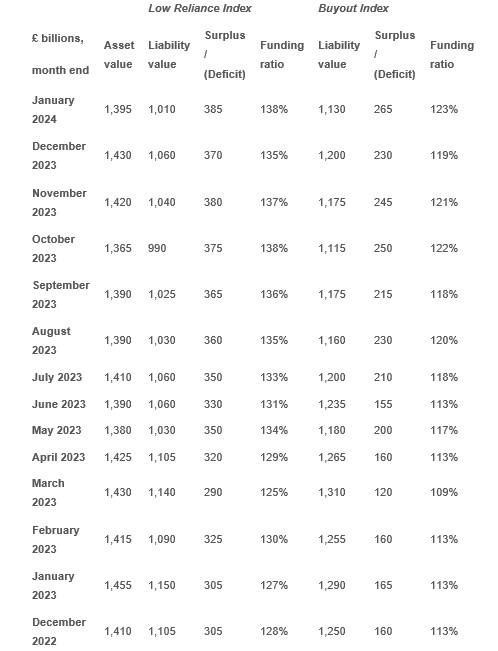

Meanwhile, PwC’s Low Reliance Index also shows a record surplus of £385bn. This tracks the position of the UK’s DB schemes based on a low-risk income-generating investment strategy, which should mean the pension scheme would be unlikely to call on the sponsor for further funding.

With wavering gilt markets and economic uncertainty over the last 12 months, schemes have generally been more conservative in their investment strategies. Yet the unprecedented levels of funding, as well as the recently announced Occupational Pensions Schemes (Funding and Investment Strategy and Amendment) Regulations, have led to an increasing number of schemes considering higher risk investment strategies.

John Dunn, head of pensions funding and transformation at PwC, said: “UK pension schemes certainly didn’t suffer from the ‘January Blues’, recording record levels of surplus, despite December and January proving to be something of a mini roller coaster ride for long-term gilt yields. Pension schemes’ conservative bond based investment strategies effectively hedged out most of the movements in the liability side of their balance sheets.

”Meanwhile global stock markets were up in the 12 months to December with the US market returning almost 25%. UK pension schemes missed out on much of this return because they have to balance the level of risk taken with the sponsor’s ability to absorb it. But what if the balance was adjusted? If we imagine a world where UK pension schemes invest only for growth and to generate surpluses for members and sponsors, the surplus at the end of 2023 would have been £300 billion higher based on those US market returns. Whether this is a missed opportunity or fool’s gold really depends on the ability of the pension scheme and its sponsor to handle the year in which asset values fell by 25% whilst still paying pensions.”

Laura Treece, senior pensions specialist at PwC, added: “The Government finalised the new funding regulations last week, announcing that the new rules are ‘explicitly more accommodating of appropriate risk taking where it is supportable’. The new rules are intended to allow even mature pension schemes to invest 20% to 30% of their core assets for growth plus the surplus assets - potentially unlocking £700bn of assets for productive investment decades into the future. This could boost not only pension schemes’ asset returns but also UK economic growth.”

The PwC Low Reliance Index and PwC Buyout Index figures are as follows:

|