|

|

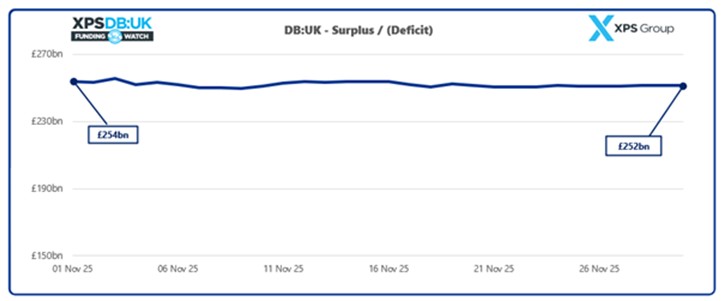

UK DB pension schemes continue to enjoy extremely positive funding positions, with XPS Group estimating aggregate surpluses of £252bn on long-term targets, up from £187bn the year prior. Scheme assets dipped slightly over November 2025, as a modest rise in bond yields reduced the value of matching assets, and global equities delivered softer than expected returns. Liabilities also eased marginally, driven by a small rise in gilt yields. |

New analysis from XPS Group shows that UK DB pension schemes maintained strong funding positions throughout November 2025, relative to long-term targets. Schemes held £1,215bn in assets (against £963bn in liabilities) marking only a slight month-on-month dip in funding levels.

The strong funding levels of many UK pension schemes were maintained through November in the lead up to the Autumn Budget. The Chancellor unveiled greater flexibilities taking effect from April 2027 with one-off payments to members from pension scheme surpluses no longer being treated as unauthorised. The reform gives trustees and employers further options to use surplus funds, and may allow members to share more directly in the benefits of stronger scheme funding.

Graham Robinson, Senior Consultant at XPS Group said: “With the continued high funding levels within DB pension schemes, the enhanced flexibility around surplus distribution announced in the recent Budget is welcome news to trustees and members alike. However, careful consideration of all stakeholders will be required when considering any surplus distribution from well-funded schemes.”

|

|

|

|

| Senior Pricing & Portfolio Management... | ||

| London - £150,000 Per Annum | ||

| Pricing Transformation Lead | ||

| London - £85,000 Per Annum | ||

| Lead Capital Actuary | ||

| London - £150,000 Per Annum | ||

| Take the lead on capital oversight | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Be at the forefront of creative GI co... | ||

| London/hybrid 2-3dpw office-based - Negotiable | ||

| Remote Market and Credit Risk Calibra... | ||

| Remote - Negotiable | ||

| Contact us about a Capital Contract i... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Head of Insurance Risk | ||

| London - £160,000 Per Annum | ||

| Director - Pensions Risk Transfer (PRT) | ||

| London, Midlands, North West - hybrid working 2dpw in the office - Negotiable | ||

| Dip a toe into public sector work wit... | ||

| Flex / hybrid 2 days p/w office-based - Negotiable | ||

| P&C Consultant | ||

| London / hybrid 3dpw office-based - Negotiable | ||

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.