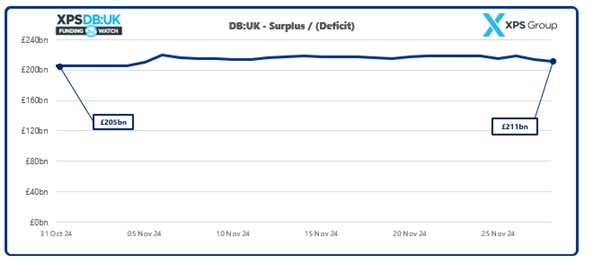

XPS Group estimates that the aggregate surplus of UK pension schemes on long-term targets remains extremely positive at ~£211bn, up from £205bn in October 2024. A fall in long-term gilt yields of ~0.1% led to an increase in the value of liabilities, reducing scheme funding levels. However, this increase was offset by positive asset returns over November 2024 from equities and bonds, leaving scheme funding levels broadly unchanged overall, remaining at record levels.

|

Over November 2024, UK pension schemes’ funding positions remained positive (relative to long-term funding targets) according to new analysis from XPS Group. With assets totalling £1,467bn and liabilities of £1,256bn, the aggregate funding level of UK pension schemes on a long-term target basis has remained at a record level of 117% of the long-term value of liabilities, as at 28 November 2024.

The Chancellor of the Exchequer, Rachel Reeves, delivered her first Mansion House speech on the evening of Thursday the 14th of November 2024. The speech signalled a promising outlook for the UK’s financial services sector and a positive trajectory for public investment. This focus aligns with the position of DB pension schemes, which have reported record surpluses in recent times.

November also saw the release of inflation data for the year to October 2024, with CPI inflation higher than expected, and above the Bank of England’s 2% target. With CPI inflation projected to remain above the 2% target for the remainder of 2024 and into 2025, further reductions in the bank rate are expected to be more gradual than previously anticipated.

Jill Fletcher, Senior Consultant at XPS Group said: “Gilt yields have stabilised following an increase during October, and immediately following the Budget, and funding levels have remained strong and relatively stable over November. Following The Pensions Regulator’s new DB funding code coming into force in November 2024, schemes with a valuation date at the end of December are approaching their first valuation under the new DB funding regulations. Trustees and sponsors will therefore need to work together to evaluate their long-term strategy and determine whether insurance is the right route for them, or whether schemes can be run-on to generate additional surplus for the benefit of both members and sponsors.”

|