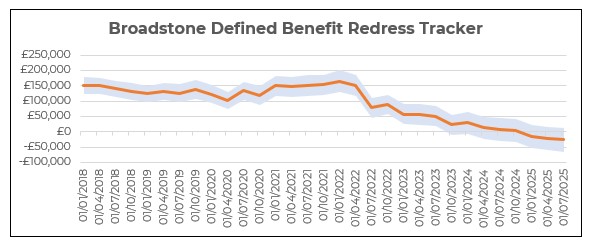

The quarterly Defined Benefit (DB) Redress Tracker from leading independent financial services consultancy Broadstone provides an indicator of the level of compensation due to those who were previously ill-advised to transfer out of their DB pension.

Broadstone’s DB Redress Tracker follows the example of an individual who left their scheme in 2018 aged 50, with a pension of £10,000 p.a. which would receive inflation-linked increases when in payment. The Tracker is developed in line with Financial Conduct Authority (FCA) rules for calculating redress with the individual assumed to have invested their funds to earn returns in line with the FTSE Private Investor Index.

The latest update shows that compensation for a typical pension transfer redress case continued to fall through H1 2025 dropping further from around -£16,500 at the end of 2024 to around -£26,000 at the end of June.

With financial conditions softening and rates rising, the Redress Tracker demonstrates the radical decline in potential DB redress since the start of 2022 when average compensation for the use case was above £150,000.

As a result of declining DB transfer compensation, Claims Management Companies (CMCs) are beginning to target advisers for DB redress claims far less. Instead, CMCs are pivoting towards more lucrative areas within the financial services industry where there are instances of ‘secret commission.’

This includes motor finance although the FCA has been clear that consumers should wait for the regulator-administered redress scheme, should that be deemed necessary following this month’s eagerly awaited Supreme Court judgment.

Other areas that are seeing more activity from CMCs include mis-selling of Defined Contribution (DC) pension scheme opt outs, a continuing focus on free-standing Additional Voluntary Contribution (AVC) mis-selling and personal loan or credit card affordability redress.

Brian Nimmo, Head of Redress Solutions at Broadstone, commented: “While the average level of DB transfer redress remains historically low and has fallen further in the first half of 2025, we’re still seeing many cases where compensation is due. This is particularly in cases where transfer values were low or where investment performance has been poor. It reinforces the importance of claimants and their advisers reviewing each case on its own merits.

“However, as this area of compensation has become less lucrative we are seeing a shift in the CMC market as they pivot towards sectors where the compensation dynamics differ and we typically see redress being paid in most of the cases. Motor finance redress remains a highly scrutinised area as we await the Supreme Court’s ruling. Consumers have been warned to wait for the FCA-run compensation scheme, should one be necessary, rather than using CMCs but this is still likely to be an area they target.”

|