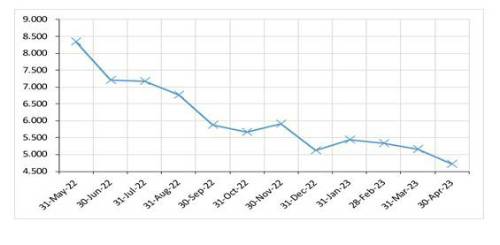

Despite a slight increase in the average time to buyout in January 2023 to 5.5 years following a fall in bond yields, the index continued to trend downwards over February, March and April.

The reduction in the index emphasises the ongoing strength of DB scheme funding positions, following the significant improvements experienced during the last quarter of 2022 (primarily driven by the increase in government bond yields after the “mini-budget”).

With many schemes now exceeding funding targets, this should prompt companies and trustees to review their DB endgame plans to ensure funding and investment strategies are calibrated appropriately.

Simon Taylor, Partner at Barnett Waddingham, said: “Despite continued financial market volatility and high levels of inflation, DB scheme funding levels remained robust during the first quarter of 2023. While we would be hesitant to describe the current environment as settled, the relative stability of the last few months has provided companies and trustees with an opportunity to take stock of their DB schemes after a turbulent end to 2022.

This period of relative calm has provided an ideal opportunity to revisit DB scheme funding and investment strategies to ensure that these remain appropriate given the significant changes we have seen during the last six months.

Irrespective of how schemes have fared during this time, there will be important questions for companies and trustees to consider when reviewing their DB scheme strategy. Whether this is locking in funding level gains, revising funding targets, or reconsidering the level of cash contributions, the material changes we have seen in the financial markets have shifted priorities and crystallised the importance of addressing certain issues.

We strongly encourage companies and trustees to take a close look at how their DB scheme strategy has fared during this time and consider whether endgame plans should be revisited or action taken to capture any short-term opportunities.”

|