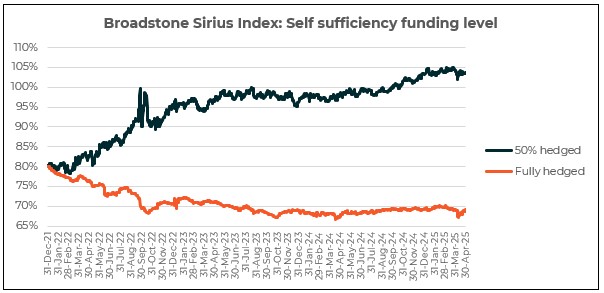

The Broadstone Sirius Index – a monitor of how various pension scheme strategies are performing on their journeys to self-sufficiency – posts its latest update.

The Broadstone Sirius Index reports its update for April 2025 – a month which saw President Trump announce his ‘Liberation Day’ tariffs driving significant volatility across global financial markets.

However, Broadstone’s fully hedged scheme weathered the turbulence, seeing no deterioration in its funding position which returned to 69.1% at the end of April - the same as at the end of the previous month. The 50% hedged scheme also recovered well from the initial market shock but saw a slight dip in funding from 104.4% at the end of March to 103.6% at the end of April, remaining above self-sufficient funding level.

Chris Rice, Head of Trustee Services at Broadstone, commented: "April was the most volatile month in pension scheme funding we’ve seen for over a year thanks to the market movements caused by the US administration’s continually evolving tariff policy. Thankfully, the initial funding deterioration was recovered as the month progressed and scheme funding was not materially impacted by the end of April. It is pleasing to see that both our fully hedged scheme and 50% hedged scheme managed to weather this turbulence well, with the benefits of hedging coming through strongly over the course of the month. Global economies are braced for further disruption as the impact of the tariffs become clearer and uncertainty lingers over the future path of the White House’s trade policy. Trustees should be closely monitoring developments but those that can navigate through this period still seem well-set to achieve their end-game objectives with a growing range of insurers servicing buoyant demand across the market. Preparation alongside solid data and administration remain the key to attracting an insurer and transacting rapidly.”

|