|

|

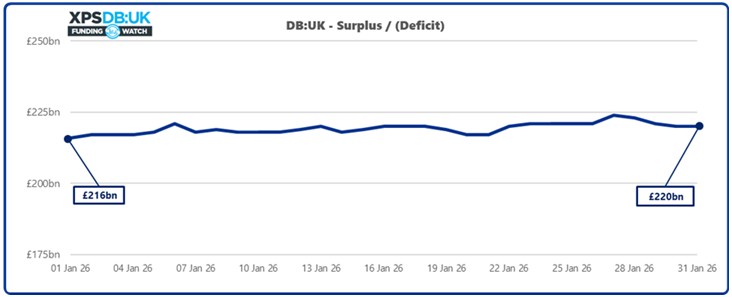

UK defined benefit (DB) pension schemes continue to maintain strong funding positions, reaching £220bn at the end January 2026 relative to long-term targets, new analysis from XPS Group shows. |

The figure represents an increase from £199bn at the same point last year, showing the steady improvement in scheme funding positions, amid intense industry focus on the long-anticipated reforms to surplus access. According to XPS, total scheme assets stood at £1,180bn, compared with £960bn of liabilities on a long-term funding basis, resulting in a modest month-on-month improvement in overall funding levels.

The continued resilient funding levels experienced by many DB schemes further highlights the potential opportunities that could be unlocked once the much-awaited flexibilities around the use of surplus funds come into force. Consultation on regulations governing surplus release is expected this year, followed by regulatory guidance in late 2026 or early 2027.

Scheme assets remained broadly stable in January 2026. Small rises in gilt yields were largely offset by a slight increase in inflation expectations, leading to a marginal fall in the value of matching assets. Returns from growth assets contributed to a modest improvement in asset values overall.

Scheme liabilities edged down modestly over January 2026, as a small rise in gilt yields was largely offset by a slight increase in inflation expectations.

Jill Fletcher, Senior Consultant at XPS Group said: “Having the option to access surplus for well-funded schemes could be a positive step for Trustees, members and sponsors. As strong funding positions persist, some Trustees and sponsors will be keenly awaiting the regulations that will enable this, so that strategic plans to run-on their schemes whilst making use of these flexibilities can be put into action.”

|

|

|

|

| Pricing Transformation Lead | ||

| London - £85,000 Per Annum | ||

| Lead Capital Actuary | ||

| London - £150,000 Per Annum | ||

| Take the lead on capital oversight | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Be at the forefront of creative GI co... | ||

| London/hybrid 2-3dpw office-based - Negotiable | ||

| Remote Market and Credit Risk Calibra... | ||

| Remote - Negotiable | ||

| Contact us about a Capital Contract i... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Head of Insurance Risk | ||

| London - £160,000 Per Annum | ||

| Director - Pensions Risk Transfer (PRT) | ||

| London, Midlands, North West - hybrid working 2dpw in the office - Negotiable | ||

| Dip a toe into public sector work wit... | ||

| Flex / hybrid 2 days p/w office-based - Negotiable | ||

| P&C Consultant | ||

| London / hybrid 3dpw office-based - Negotiable | ||

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

| Play a vital role in shaping a new He... | ||

| London or Scotland / hybrid 50/50 - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.