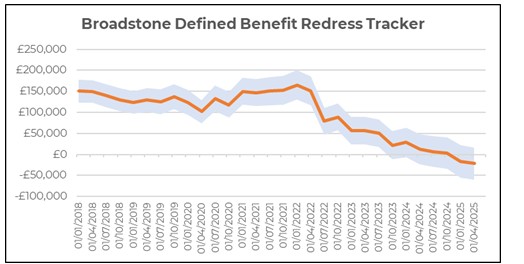

The quarterly Defined Benefit (DB) Redress Tracker from leading independent financial services consultancy Broadstone provides an indicator of the level of compensation due to those who were previously ill-advised to transfer out of their DB pension.

Broadstone’s DB Redress Tracker follows the example of an individual who left their scheme in 2018 aged 50, with a pension of £10,000 p.a. which would receive inflation-linked increases when in payment. The Tracker is developed in line with Financial Conduct Authority (FCA) rules for calculating redress with the individual assumed to have invested their funds to earn returns in line with the FTSE Private Investor Index.

The latest update shows that compensation for a typical pension transfer redress case continued to fall through Q1 2025 dropping from around -£16,000 at the end of 2024 to around -£22,000 at the end of March.

However, additional modelling shows the recent market volatility over the past week has reversed all of the downward movements recorded through Q1 with indicative compensation levels now back to around -£16,000. If markets continue to fall, then it is likely that redress levels will continue to trend upwards in the second half of the year.

With financial conditions softening and rates rising, the Redress Tracker demonstrates the radical decline in potential DB redress since the start of 2022 when average compensation for the use case was above £150,000.

However, there is significant volatility in individual redress levels which can vary widely based on factors like the initial generosity of transfer values or investment returns meaning redress is still payable in some cases.

Brian Nimmo, Head of Redress Solutions at Broadstone, said that the current market volatility and personalised approach to calculating DB transfer redress highlights the importance of taking a case-by-case approach to claims.

He said: “The recent market turmoil has the potential to shift the redress landscape – what has been a consistently downward trend for the past three years now points towards the possibility of a reversal as we look towards Q3 2025. Moreover, while the average level of redress may have dipped in Q1 2025 we’re still seeing many cases where compensation is due – particularly where transfer values were low or where investment performance has been poor. This reinforces the importance of claimants and their advisers reviewing each case on its own merits. We’re also continuing to assess redress in cases beyond pension transfers, such as mis-sold free-standing AVCs, where the compensation dynamics differ and we typically see redress being paid in most of the cases. Market-wide trackers are useful for spotting broad trends, but they can sometimes gloss over the complexity of individual cases. With conditions shifting so rapidly, a deeper understanding of redress drivers is more important than ever.”

|