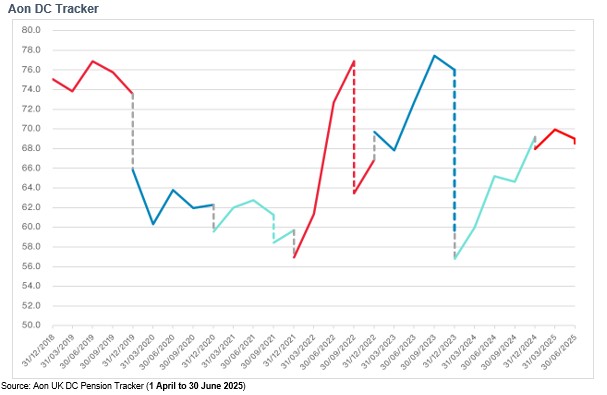

Over the quarter (April to June 2025), the Aon UK DC Pension Tracker fell, which suggests the expected future living standard in retirement provided by defined contribution (DC) savings was lower than at the end of the previous quarter.

Note, the sample savers used in the Aon DC Tracker were ’re-set’ to their original age and fund values at the year-end which results in the discontinuity (shown in grey in the chart above) as at 31 December 2024.

Over the second quarter of 2025 (April to June ), the Tracker fell from 70.0 to 68.2. This fall was driven by a reduction in expected future returns pre-retirement and increases to the Retirement Living Standards which were offset by the increase in the state pension in April. However, our older sample savers (aged 50 and 60) saw their expected retirement income increase, as a result of strong benchmark investment returns over the quarter and an increase in expected return assumptions post-retirement.

2025 Retirement Living Standards: smaller changes bring relief for savers

The second quarter of 2025 saw the latest update to Pensions UK’s Retirement Living Standards. In a welcome development for savers, this year’s changes were much more modest compared to the significant rises seen in 2022 and 2023 [Note, there was no update to the living standards in 2024].

Most notably, the amount needed to meet the minimum living standard actually fell by £1,000 (a decrease of around 7 percent to £13,400 per year. The amount required for a moderate standard increased slightly by £400 per year (about 1.2 percent), which is less than the recent state pension increase of £470 per year. As a result, those aiming for a moderate standard could be better off in retirement, all else being equal.

The comfortable living standard saw the largest rise: up 1.85 percent (£800 per year). However, this increase was still largely offset by the April increase in the State Pension.

Matthew Arends, partner and head of UK Retirement Policy at Aon, said: “After several years of sharp increases to the Retirement Living Standards, savers can take some comfort that the 2025 update is more restrained. For pensioners aiming for minimum or moderate living standards, the higher State Pension will more than cover the increase. However, it’s important to remember that household budgets remain tight and inflation continues to be above the Bank of England target. For many households, saving for retirement continues to be a challenge.”

Navigating market volatility: pensions remain a long-term investment. The financial landscape in 2025 has been marked by significant volatility. Global headlines have been dominated by new tariff announcements and persistent geopolitical tensions, that have unsettled markets and created a challenging environment for investors. In the second quarter, investment performance rebounded following a weak start in Q1. Many pension savers will have noticed significant swings in the value of their retirement savings.

Matthew Arends, said: “Pensions are, of course, a long-term investment. Market volatility is inevitable over such a lengthy time horizon as a working lifetime. For younger savers, this can actually work in their favour, allowing them to benefit from periods of lower asset prices by continuing to invest regularly. Over time, this can smooth out the impact of fluctuations and potentially enhance long-term returns through pound-cost averaging.

“Nevertheless, many savers will find the swings in the value of their retirement savings concerning, particularly as retirement approaches. Ensuring your investments gradually moves towards lower-risk assets (as is common in most default funds) can help protect the value of your savings from sudden market swings when you need the money most.”

Movement over the second quarter of the year

The decrease in the Aon UK DC Pension Tracker over the second quarter of 2025 was primarily driven by a fall in expected future return assumptions pre-retirement and increases to the retirement living standards. On an individual saver basis, movements over the quarter were mixed.

The youngest saver saw the largest decrease of around £1,085 p.a. (2.9 percent) driven by a decrease in future expected return assumptions pre-retirement. This was partially offset by positive actual investment performance over the quarter and the increase to the state pension.

The 40-year-old saver saw a decrease of £750 p.a. (or 1.8 percent) in their expected retirement income. Again, this was driven by a decrease in the expected future investment return assumptions offsetting positive actual investment performance and state pension increases over the quarter.

Our 50-year-old saver saw an increase of around £200 p.a. (or 0.5 percent) in their expected retirement income. Due to this saver’s larger existing funds, they benefited the most from the strong investment performance, particularly in equity markets, over the quarter. This was partially offset by decreases in expected future return assumptions pre-retirement.

The oldest savers saw the largest increase of around £550 p.a. (2.4 percent). This was driven by an increase to post-retirement expected return assumptions, which benefited the members closest to retirement most, together with positive investment performance over the period.

Overall, the oldest saver is expected to be the worst off in retirement, albeit with a retirement income of around 150 percent of the ‘minimum’ Retirement Living Standard. This excludes any defined benefit pension benefits they may have but which are not included in this projection.

|