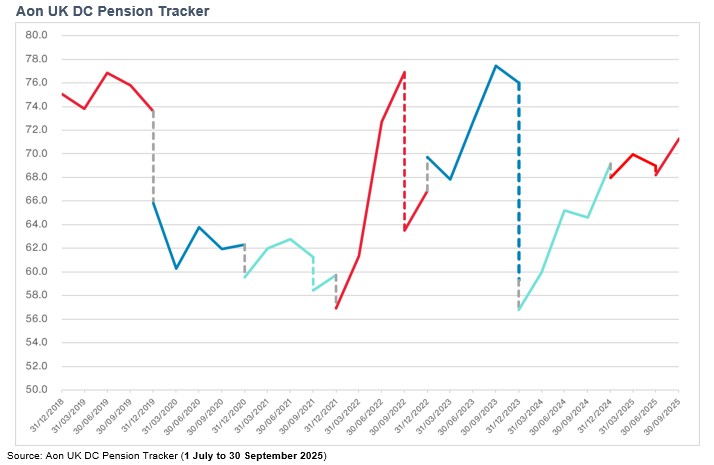

Over the quarter (July to September 2025), the Aon UK DC Pension Tracker rose, which suggests the expected future living standard in retirement provided by defined contribution (DC) savings was higher than at the end of the previous quarter.

Note, the sample savers used in the Aon DC Tracker were ’re-set’ to their original age and fund values at each year-end which results in the discontinuities (shown in grey in the chart above) as at each 31 December.

The Tracker rose from 68.2 to 71.3 over the third quarter of 2025. This rise was driven by positive benchmark investment returns over the quarter, particularly in equity markets, and, to a lesser extent, an increase in expected return assumptions post-retirement. This has resulted in an increase in expected retirement income for all savers, though older savers benefited the most over the period from the impact of strong benchmark performance on their larger existing pots.

The Budget: Little festive cheer for DC pension savers

The Budget saw several pension announcements from Chancellor Rachel Reeves, including the implementation of a £2,000 cap on the level of salary sacrificed pension contributions that will be exempt from National Insurance (NI) from April 2029.

This change aims to limit the impact of NI savings obtained through salary sacrifice while protecting lower earners. For a DC saver earning the UK median salary (just under £40,000 p.a.) and paying auto-enrolment minimum contributions via salary sacrifice, there will be no immediate change to the NI contributions due as a result of this change (as their annual pension contributions would remain under the £2,000 cap). However, as that saver’s salary grows over time, they would begin to be affected if the cap remains frozen at £2,000.

The biggest impact of the change will be felt by employers who could see a significant increase in their NI bill. For an employee making £10,000 of pension contributions through salary sacrifice, the changes will result in the employer paying an additional £1,200 in NI contributions (NICs)for that employee alone. By comparison, if the employee were earning over approximately £50,000 a year the change would only increase their NICs by £160 (or around £13 per month).

Matthew Arends, partner and head of UK Retirement Policy at Aon, said: “While these changes will reduce employee take-home pay and increase employer costs for DC savers making annual contributions in excess of £2,000 per year, it is vital to remember that salary sacrifice will remain a valuable option for employees saving towards retirement. As the changes are not being implemented until April 2029, in the run-up to the change there is a window of opportunity for sponsors and employees to maximise their use of salary sacrifice, potentially through options such as bonus sacrifice. Another notable announcement in the Chancellor’s Budget was that the freeze on income tax (and National Insurance) thresholds will be extended by three years to April 2031.

“Given tax thresholds are now expected to remain frozen until 2031, more and more employees will find themselves affected by higher income tax rates and the potential loss of benefits. For these employees, salary sacrifice has the added attraction of being an option to manage certain benefit cliff edges, including the removal of childcare cost subsidy or avoiding the 60 percent ‘tax trap’ notwithstanding the loss of the NIC saving.”

Movement over the third quarter of the year

The increase in the Aon UK DC Pension Tracker over the third quarter of 2025 was primarily driven by positive benchmark performance over the period and an increase in expected future return assumptions post-retirement. On an individual saver basis, movements over the quarter were positive at all ages.

The youngest saver saw the smallest increase of around £450 p.a. (1.3 percent) driven by positive actual investment performance over the quarter. This was partially offset by a decrease in expected future investment return assumptions pre-retirement.

The 40-year-old saver saw an increase of around £1,200 p.a. (or 2.9 percent) in their expected retirement income. Again, this was driven by positive actual investment performance over the quarter and a rise in post-retirement expected future returns that were offset to a degree by a reduction in the expected future return pre-retirement.

Our 50-year-old saver saw the largest increase of around £1,50 p.a. (or 4.0 percent) in their expected retirement income. Due to this saver’s larger existing funds, they benefited the most from the strong investment performance, particularly in equity markets, over the quarter. Again, this was partially offset by decreases in expected future return assumptions pre-retirement.

The oldest savers saw an increase of around £600 p.a. (2.6 percent). This was driven by an increase to post-retirement expected return assumptions, which benefited the members closest to retirement most, together with positive investment performance over the period.

Overall, the oldest saver is expected to be the worst off in retirement, albeit with a retirement income of around 150 percent of the ‘minimum’ Retirement Living Standard. This excludes any defined benefit pension benefits they may have but which are not included in this projection.

|